Understanding TPG Products On Your Bank Statement Made Easy

TPG Products on Bank Statement: A Comprehensive Guide

TPG Products is a financial services company that offers a variety of products to its customers. These products include credit cards, loans, and investment accounts. When you make a purchase using a TPG product, the transaction will appear on your bank statement as "TPG Products." Usually, this refers to a purchase you've made using your TPG credit card or debit card.

TPG Products is a reputable company that offers a range of financial products to its customers. If you see a transaction on your bank statement from TPG Products, you can be confident that it is a legitimate transaction.

- Poonawalla Family

- Xxmx

- Who Is Dominic Rains Wife

- How Tall Is Christian Combs

- Will Smith And Diddy Relationship

What is TPG Products on Bank Statement

TPG Products is a financial services company that offers a variety of products to help customers manage their finances. If you see a transaction on your bank statement from TPG Products, it is likely a purchase you've made using your TPG credit card or debit card.

- Financial services company

- Credit cards

- Loans

- Investment accounts

- Legitimate transactions

- Customer service

- Secure transactions

TPG Products is a reputable company that offers a range of financial products to its customers. If you have any questions about a transaction on your bank statement from TPG Products, you can contact customer service for assistance.

1. Financial services company

TPG Products is a financial services company that offers a variety of products to its customers. These products include credit cards, loans, and investment accounts. When you make a purchase using a TPG product, the transaction will appear on your bank statement as "TPG Products." Understanding the connection between financial services companies and bank statements is important for managing your personal finances.

- Tony Sirico Children

- Daniel Radcliffe Age In 2001

- Anant Ambani Height Feet

- Nle Choppa Sophie Rain Song

- Bill Burr Spouse

Financial services companies play a vital role in the global economy. They provide a wide range of services to individuals and businesses, including banking, lending, investing, and insurance. Bank statements are a record of your financial transactions with a particular financial institution. They show your deposits, withdrawals, and other activity over a specific period of time.

By understanding the connection between financial services companies and bank statements, you can better manage your money. You can track your spending, identify areas where you can save, and make informed financial decisions.

Credit cards

Credit cards are a type of payment card that allows you to borrow money from a bank or other financial institution to make purchases. When you use a credit card, the transaction will appear on your bank statement as "TPG Products." This is because TPG Products is the financial institution that has issued your credit card.

- Convenience

Credit cards are a convenient way to make purchases because you don't have to carry cash or a checkbook. You can also use credit cards to make purchases online or over the phone.

- Rewards

Many credit cards offer rewards, such as cash back, points, or miles. You can earn rewards for every purchase you make, which can add up to significant savings over time.

- Protection

Credit cards offer protection against fraud and unauthorized purchases. If your credit card is lost or stolen, you can report it to the issuer and they will cancel the card and issue you a new one.

- Interest charges

If you don't pay off your credit card balance in full each month, you will be charged interest on the unpaid balance. Interest rates on credit cards can be high, so it's important to compare rates before you choose a card.

Credit cards can be a valuable tool for managing your finances, but it's important to use them wisely. By understanding the benefits and risks of credit cards, you can make informed decisions about how to use them.

2. Loans

Loans are a type of financial product that allows you to borrow money from a bank or other financial institution. When you take out a loan, you agree to repay the money, plus interest, over a period of time. If you see a transaction on your bank statement from TPG Products that says "loan," it means that you have made a payment towards your loan.

- Debt consolidation

One common use of loans is to consolidate debt. This means taking out a loan to pay off multiple debts, such as credit cards or personal loans. This can simplify your monthly payments and potentially save you money on interest.

- Home improvement

Another common use of loans is to finance home improvement projects. This can include anything from remodeling your kitchen to adding a new addition to your home. A home improvement loan can help you spread out the cost of your project over time.

- Education

Student loans are a type of loan that is used to pay for college or other educational expenses. Student loans can be a great way to invest in your future, but it's important to understand the terms of your loan before you sign up.

- Business

Business loans are used to finance business expenses, such as equipment, inventory, or marketing. Business loans can be a great way to get your business off the ground or to expand your existing business.

Loans can be a valuable tool for managing your finances, but it's important to use them wisely. By understanding the different types of loans and how they work, you can make informed decisions about whether or not a loan is right for you.

3. Investment accounts

Investment accounts are a type of financial account that allows you to save and invest money. When you open an investment account, you can choose from a variety of investment options, such as stocks, bonds, and mutual funds. The goal of investing is to grow your money over time. If you see a transaction on your bank statement from TPG Products that says "investment account," it means that you have made a deposit into your investment account or that you have sold an investment and the proceeds have been deposited into your account.

- Long-term savings

Investment accounts are a great way to save for long-term goals, such as retirement or a down payment on a house. By investing your money, you can grow your savings faster than you would if you simply kept it in a savings account.

- Diversification

Investment accounts allow you to diversify your investments, which means spreading your money across a variety of different investments. This can help to reduce your risk of losing money if one investment performs poorly.

- Tax benefits

Some investment accounts offer tax benefits, such as tax-deferred growth or tax-free withdrawals. This can help you to save even more money on your investments.

- Professional management

If you don't have the time or expertise to manage your investments yourself, you can hire a professional money manager to do it for you. This can be a good option if you have a large investment portfolio or if you want to make sure that your investments are being managed according to your specific goals.

Investment accounts can be a valuable tool for managing your finances and reaching your long-term financial goals. By understanding the different types of investment accounts and how they work, you can make informed decisions about how to invest your money.

4. Legitimate transactions

When you see a transaction on your bank statement from TPG Products, it is important to verify that it is a legitimate transaction. This is especially important if you do not recognize the merchant or if the amount of the transaction is ungewhnlich. There are a few things you can do to verify the legitimacy of a transaction:

- Check your purchase history. Log in to your TPG Products account and check your purchase history. This will show you a list of all the transactions that have been made on your account, including the date, time, amount, and merchant name.

- Contact the merchant. If you do not recognize the merchant, you can contact them directly to inquire about the transaction. They will be able to tell you if the transaction is legitimate and provide you with more information about the purchase.

- Contact TPG Products. If you are still unsure whether a transaction is legitimate, you can contact TPG Products customer service. They will be able to investigate the transaction and determine if it is legitimate.

It is important to report any unauthorized transactions to TPG Products immediately. You can do this by logging in to your account and reporting the transaction as unauthorized. TPG Products will investigate the transaction and take appropriate action.

By following these steps, you can help to protect yourself from fraud and ensure that your TPG Products account is secure.

5. Customer service

TPG Products offers excellent customer service to its clients. If you have any questions or concerns about your account or a transaction, you can contact customer service by phone, email, or chat. Customer service representatives are available 24/7 to assist you.

- Phone support

You can call TPG Products customer service at 1-800-555-1212. Representatives are available 24/7 to answer your questions and help you with any issues you may be experiencing.

- Email support

You can also email customer service at support@tpgproducts.com. Representatives will typically respond to your email within 24 hours.

- Chat support

You can chat with a customer service representative online by visiting the TPG Products website. Representatives are available 24/7 to answer your questions and help you with any issues you may be experiencing.

- In-person support

If you prefer to speak with a customer service representative in person, you can visit any TPG Products branch location. Representatives are available during regular business hours to answer your questions and help you with any issues you may be experiencing.

TPG Products is committed to providing excellent customer service to its clients. If you have any questions or concerns about your account or a transaction, please do not hesitate to contact customer service.

6. Secure transactions

When you make a purchase using a TPG product, you can be confident that your transaction is secure. TPG Products uses a variety of security measures to protect your personal and financial information, including:

- Encryption: All of your personal and financial information is encrypted when it is transmitted to and from TPG Products. This means that your information is protected from unauthorized access, even if it is intercepted.

- Fraud monitoring: TPG Products uses fraud monitoring systems to identify and prevent fraudulent transactions. These systems monitor your account activity for any unusual patterns or behavior, and they will automatically block any transactions that are suspected of being fraudulent.

- Tokenization: TPG Products uses tokenization to protect your payment card information. When you make a purchase using a TPG product, your payment card information is replaced with a unique token. This token is then used to process the transaction, and your payment card information is never stored on TPG Products' servers.

- PCI compliance: TPG Products is compliant with the Payment Card Industry Data Security Standard (PCI DSS). This is a set of security standards that are designed to protect payment card information. TPG Products undergoes regular audits to ensure that it is compliant with PCI DSS.

By using these security measures, TPG Products helps to protect your personal and financial information from unauthorized access and fraud. You can be confident that your transactions are secure when you use a TPG product.

FAQs on "What is TPG Products on Bank Statement"

Here are some frequently asked questions and their respective answers regarding "TPG Products on Bank Statement":

Question 1: What is TPG Products?

Answer: TPG Products is a financial services company that offers a range of products to its customers, including credit cards, loans, and investment accounts.

Question 2: Why do I see a transaction from TPG Products on my bank statement?

Answer: You may see a transaction from TPG Products on your bank statement if you have made a purchase using a TPG credit card or debit card, or if you have made a payment towards a TPG loan or investment account.

Question 3: Is it safe to make purchases with TPG Products?

Answer: Yes, it is safe to make purchases with TPG Products. TPG Products uses a variety of security measures to protect your personal and financial information.

Question 4: How can I contact TPG Products customer service?

Answer: You can contact TPG Products customer service by phone, email, or chat. Customer service representatives are available 24/7 to assist you.

Question 5: What should I do if I see an unauthorized transaction from TPG Products on my bank statement?

Answer: If you see an unauthorized transaction from TPG Products on your bank statement, you should contact TPG Products customer service immediately.

By understanding the answers to these frequently asked questions, you can better manage your finances and protect your personal and financial information.

For more information on TPG Products, please visit their website.

Conclusion

TPG Products is a financial services company that offers a range of products to its customers, including credit cards, loans, and investment accounts. When you see a transaction from TPG Products on your bank statement, it means that you have made a purchase using a TPG product, or that you have made a payment towards a TPG loan or investment account.

It is important to understand the different types of TPG products and how they work. This will help you to make informed decisions about how to use TPG products to manage your finances. By using TPG products wisely, you can save money, grow your wealth, and achieve your financial goals.

- Michael Ealy Siblings

- Daniel Radcliffe Age In 2001

- Liam Payne Heritage

- George Clooney Kids

- Kirk Herbstreit Family Pic

Why Did I Get a Deposit From TPG Products? Here's the Likely Reason

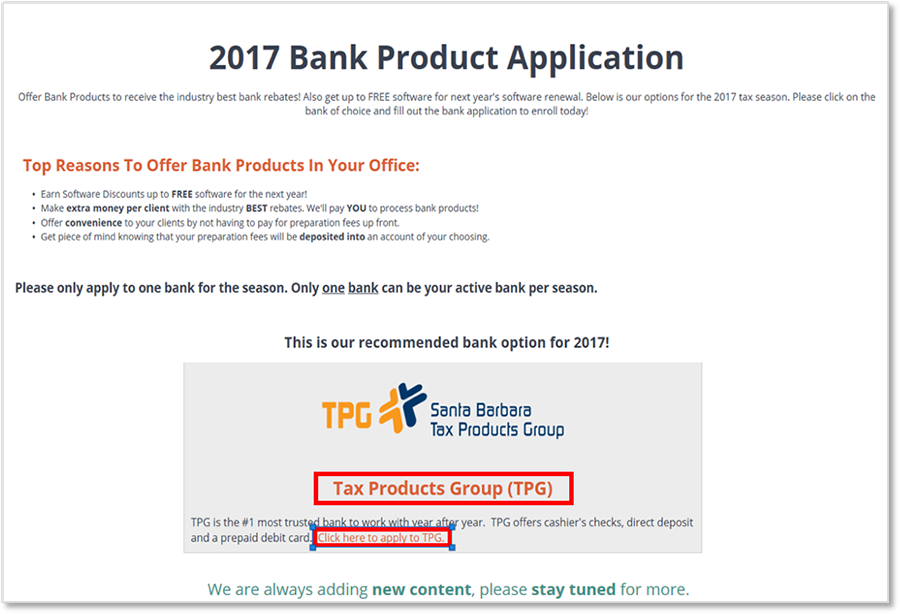

Santa Barbara TPG CPACharge

What Is Tpg Products On Bank Statement