2023 Robinhood 1099 Tax Form: When To Expect It

When is the Robinhood 1099 available?

The Robinhood 1099 is a tax form that reports income earned from Robinhood, a popular online brokerage. The 1099 is typically available in late January or early February of the year following the tax year in question. For example, the 1099 for the 2022 tax year will likely be available in late January or early February of 2023.

It's important to note that the Robinhood 1099 is not the same as a W-2 form. A W-2 form reports wages and salaries earned from an employer, while a 1099 reports income earned from self-employment or other non-employee sources. If you received income from Robinhood in 2022, you should receive a 1099 form from Robinhood in early 2023.

Here are some of the benefits of using Robinhood:

- Robinhood offers commission-free trading on stocks, ETFs, and options.

- Robinhood has a user-friendly mobile app that makes it easy to trade on the go.

- Robinhood offers a variety of educational resources to help investors learn about the stock market.

If you're interested in learning more about Robinhood, you can visit their website at robinhood.com.

Robinhood 1099 Date

The Robinhood 1099 date is an important piece of information for taxpayers who use Robinhood, a popular online brokerage. The 1099 date is the date that Robinhood sends out its 1099 forms to its users. This form reports the income that users earned from Robinhood during the previous tax year.

- Amber Heard And Jason Momoa Together

- Dak Prescott First Wife

- Zahn Mcclarnon Partner

- Bill Hemmer Relationships

- Alec Bohm Family

- Availability: The Robinhood 1099 date is typically in late January or early February.

- Importance: The 1099 date is important because it helps taxpayers file their taxes accurately and on time.

- Accuracy: The 1099 date is used by the IRS to verify the income that taxpayers report on their tax returns.

- Timeliness: The 1099 date is important for taxpayers who want to file their taxes early.

- Exceptions: There are some exceptions to the Robinhood 1099 date. For example, if a taxpayer earns less than $600 from Robinhood, they may not receive a 1099 form.

- Assistance: Taxpayers who have questions about the Robinhood 1099 date can contact Robinhood customer service for assistance.

The Robinhood 1099 date is an important piece of information for taxpayers who use Robinhood. By understanding the 1099 date, taxpayers can file their taxes accurately and on time.

1. Availability

The Robinhood 1099 date is typically in late January or early February because the IRS requires all businesses to send out 1099 forms to their customers by January 31st. This deadline gives taxpayers time to file their taxes accurately and on time.

- Filing Taxes: The Robinhood 1099 date is important for taxpayers who want to file their taxes early. By having the 1099 form in hand, taxpayers can start preparing their taxes as soon as possible.

- Avoiding Penalties: Taxpayers who file their taxes late may have to pay penalties and interest. By having the Robinhood 1099 date in mind, taxpayers can avoid these penalties by filing their taxes on time.

- Peace of Mind: Knowing the Robinhood 1099 date can give taxpayers peace of mind. By knowing when to expect the form, taxpayers can avoid worrying about missing the deadline.

The Robinhood 1099 date is a crucial piece of information for taxpayers who use Robinhood. By understanding the 1099 date, taxpayers can file their taxes accuracy and on time.

2. Importance

The Robinhood 1099 date is important for several reasons. First, it helps taxpayers file their taxes accurately. The 1099 form reports the income that taxpayers earned from Robinhood during the previous tax year. This information is essential for taxpayers to correctly calculate their tax liability.

- Timely Filing: The Robinhood 1099 date also helps taxpayers file their taxes on time. The IRS requires taxpayers to file their taxes by April 15th. By having the 1099 form in hand, taxpayers can start preparing their taxes as soon as possible and avoid the risk of filing late.

- Avoiding Penalties: Taxpayers who file their taxes late may have to pay penalties and interest. The Robinhood 1099 date helps taxpayers avoid these penalties by giving them ample time to file their taxes on time.

- Peace of Mind: Knowing the Robinhood 1099 date can give taxpayers peace of mind. By knowing when to expect the form, taxpayers can avoid worrying about missing the deadline and can plan accordingly.

Overall, the Robinhood 1099 date is a crucial piece of information for taxpayers who use Robinhood. By understanding the 1099 date, taxpayers can file their taxes accurately and on time, avoiding penalties and ensuring a smooth tax filing process.

3. Accuracy

The Robinhood 1099 date is important because it helps the IRS verify the income that taxpayers report on their tax returns. The IRS uses the 1099 date to ensure that taxpayers are reporting all of their income, including income from Robinhood.

- Timely Reporting: The Robinhood 1099 date helps the IRS ensure that taxpayers are reporting their income in a timely manner. The IRS requires taxpayers to file their taxes by April 15th. By having the Robinhood 1099 date in mind, taxpayers can avoid filing their taxes late and potentially facing penalties.

- Accurate Reporting: The Robinhood 1099 date helps the IRS ensure that taxpayers are reporting their income accurately. The 1099 form reports the income that taxpayers earned from Robinhood during the previous tax year. This information is essential for taxpayers to correctly calculate their tax liability.

- Avoiding Audits: The Robinhood 1099 date can help taxpayers avoid audits. The IRS may audit taxpayers who fail to report all of their income, including income from Robinhood. By having the Robinhood 1099 date in mind, taxpayers can avoid making mistakes on their tax returns and potentially facing an audit.

Overall, the Robinhood 1099 date is a crucial piece of information for taxpayers who use Robinhood. By understanding the 1099 date, taxpayers can file their taxes accurately and on time, avoiding penalties and ensuring a smooth tax filing process.

4. Timeliness

The Robinhood 1099 date is important for taxpayers who want to file their taxes early because it gives them ample time to gather their tax documents, prepare their tax return, and file their taxes before the April 15th deadline. Filing taxes early has several benefits, including:

- Avoiding late filing penalties: The IRS charges penalties for late filing, so filing early can help taxpayers avoid these unnecessary expenses.

- Getting a refund sooner: If a taxpayer is expecting a refund, filing early can help them get their refund sooner.

- Reducing stress: Filing taxes can be stressful, so filing early can help taxpayers reduce their stress levels by giving them more time to complete the process.

To file their taxes early, taxpayers need to have all of their tax documents, including their Robinhood 1099 form. The Robinhood 1099 form reports the income that taxpayers earned from Robinhood during the previous tax year. This information is essential for taxpayers to correctly calculate their tax liability.

Taxpayers can access their Robinhood 1099 form online by logging into their Robinhood account. The 1099 form is typically available in late January or early February.

By understanding the connection between the Robinhood 1099 date and filing taxes early, taxpayers can take steps to ensure that they file their taxes accurately and on time.

5. Exceptions

The Robinhood 1099 date is typically in late January or early February. However, there are some exceptions to this rule. One exception is for taxpayers who earn less than $600 from Robinhood. These taxpayers may not receive a 1099 form from Robinhood.

- Reason for the Exception: The reason for this exception is that the IRS does not require businesses to send 1099 forms to taxpayers who earn less than $600 from them. This is because the IRS considers these payments to be de minimis, or too small to report.

- Impact on Taxpayers: This exception can have a significant impact on taxpayers who earn less than $600 from Robinhood. These taxpayers may not be aware that they are required to report this income on their tax returns, even if they do not receive a 1099 form.

- How to Report Income: Taxpayers who earn less than $600 from Robinhood can report this income on their tax returns by using Schedule C. Schedule C is used to report income from self-employment.

It is important to note that taxpayers are still responsible for reporting all of their income on their tax returns, even if they do not receive a 1099 form. Taxpayers who fail to report all of their income may be subject to penalties and interest.

6. Assistance

The Robinhood 1099 date is an important piece of information for taxpayers who use Robinhood, a popular online brokerage. The 1099 date is the date that Robinhood sends out its 1099 forms to its users. This form reports the income that users earned from Robinhood during the previous tax year. Taxpayers who have questions about the Robinhood 1099 date can contact Robinhood customer service for assistance.

- Availability of Assistance: Robinhood offers customer service support to taxpayers who have questions about the 1099 date. Taxpayers can contact Robinhood customer service via phone, email, or live chat.

- Types of Questions: Robinhood customer service can answer a variety of questions about the 1099 date, including when the 1099 forms will be available, what information is included on the 1099 forms, and how to report the income from Robinhood on a tax return.

- Importance of Seeking Assistance: Taxpayers who are unsure about the Robinhood 1099 date or have other questions about their Robinhood account should contact Robinhood customer service for assistance. Robinhood customer service can help taxpayers understand the 1099 date and ensure that they are reporting their income accurately on their tax returns.

The Robinhood 1099 date is an important piece of information for taxpayers who use Robinhood. Taxpayers who have questions about the Robinhood 1099 date should contact Robinhood customer service for assistance.

Robinhood 1099 Date FAQs

This section addresses frequently asked questions (FAQs) about the Robinhood 1099 date, providing clear and concise answers to common concerns and misconceptions.

Question 1: When is the Robinhood 1099 typically available?

Answer: The Robinhood 1099 is typically available in late January or early February of the year following the tax year in question.

Question 2: Why is the Robinhood 1099 date important?

Answer: The Robinhood 1099 date is important because it helps taxpayers file their taxes accurately and on time. The 1099 form reports the income earned from Robinhood during the previous tax year, which is essential information for calculating tax liability.

Question 3: What should I do if I don't receive a Robinhood 1099?

Answer: If you earned more than $600 from Robinhood during the tax year, you should contact Robinhood customer service to inquire about your 1099 form. It is important to report all income, even if you do not receive a 1099 form.

Question 4: How can I contact Robinhood customer service about my 1099?

Answer: You can contact Robinhood customer service via phone, email, or live chat through the Robinhood website or mobile app.

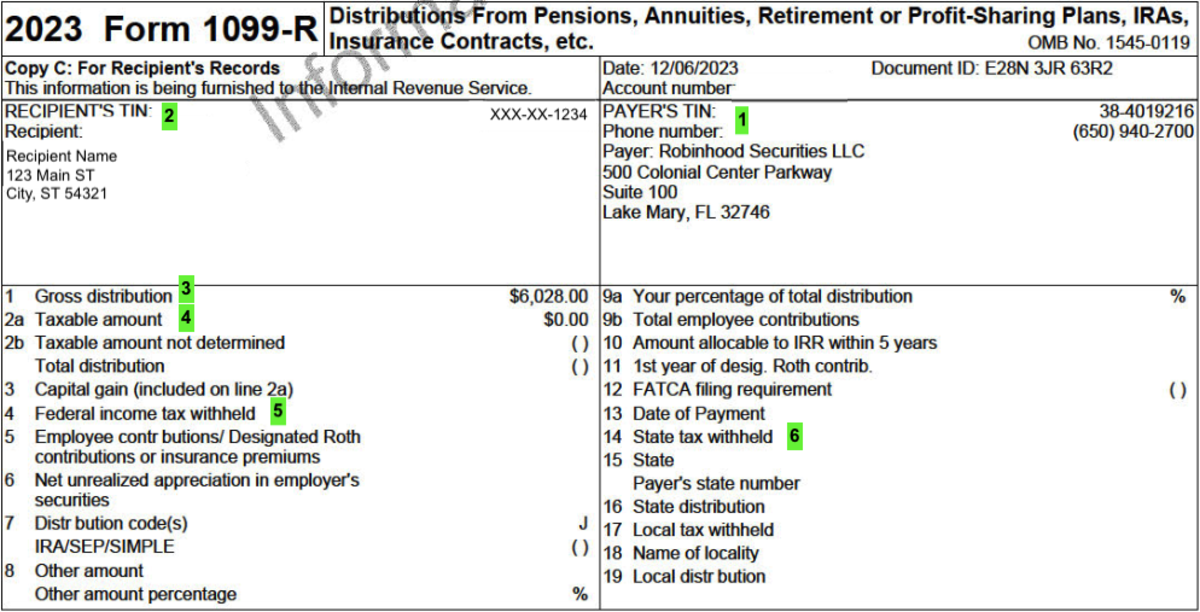

Question 5: What information is included on the Robinhood 1099?

Answer: The Robinhood 1099 includes information such as your name, address, Social Security number, income earned from Robinhood, and any taxes withheld.

Remember to consult official sources like the Robinhood website or the IRS for the most up-to-date and accurate information.

Transitioning to the next section...

Robinhood 1099 Date

The Robinhood 1099 date is a crucial piece of information for taxpayers who use Robinhood. By understanding the 1099 date and its implications, taxpayers can ensure that they file their taxes accurately and on time, avoiding potential penalties and ensuring a smooth tax filing process.

Key takeaways from this exploration of the Robinhood 1099 date include:

- The Robinhood 1099 date is typically in late January or early February.

- The 1099 date is important for filing taxes accurately and on time.

- The IRS uses the 1099 date to verify the income that taxpayers report on their tax returns.

- Taxpayers who file their taxes late may have to pay penalties and interest.

- Taxpayers can contact Robinhood customer service for assistance with any questions about the 1099 date.

By staying informed about the Robinhood 1099 date and following best practices for tax filing, taxpayers can ensure that they meet their tax obligations and avoid any unnecessary complications.

- Max Thieriot

- Chrissy Teigen First Husband

- Adam Sandlers Wife Grown Ups

- Vanessa Bryant Weight Loss

- Sabrina Carpenter Transformation

How to read your 1099R and 5498 Robinhood

How to read your 1099R and 5498 Robinhood

Robinhood Tax Forms 2024 Nelly Yevette