Swimply Net Worth: How Much Is The Swimming Pool Rental Company Worth?

What is "Swimply Net Worth"?

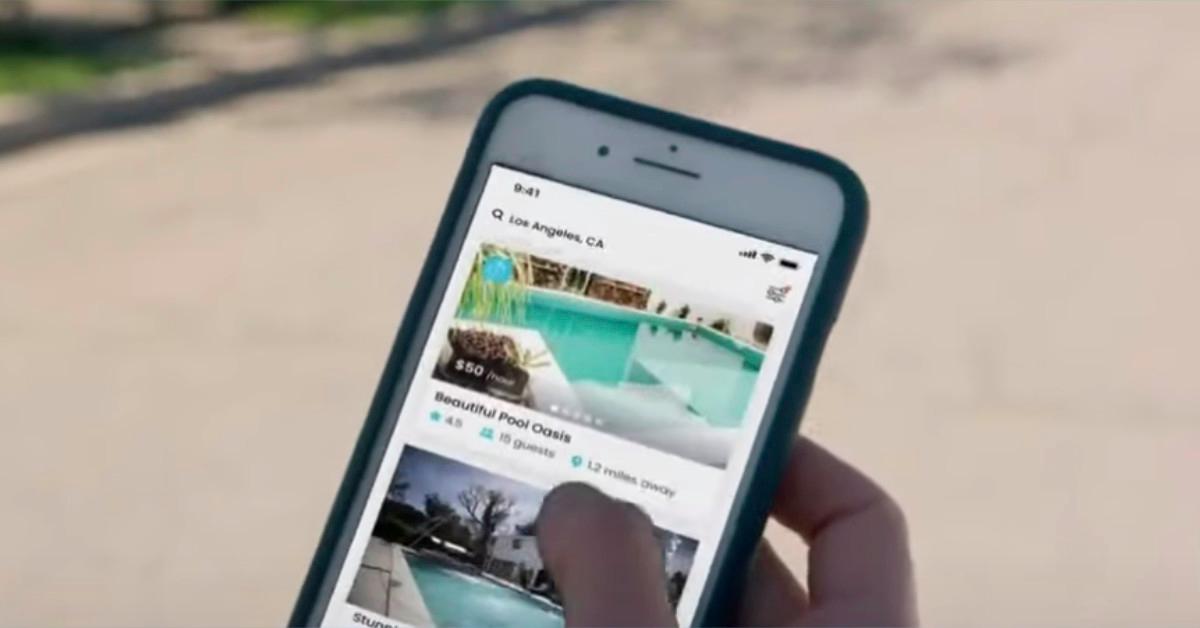

Swimply is a website and app that allows users to rent out their swimming pools to other users. The company was founded in 2018 and is based in Los Angeles, California. Swimply has raised over $40 million in funding from investors such as Greycroft, Accel Partners, and Shasta Ventures.

The company's net worth is estimated to be in the tens of millions of dollars. This is due to the fact that Swimply has a large and growing user base. The company also has a strong revenue model, as it charges a commission on each booking. In 2021, Swimply generated over $100 million in revenue.

Swimply is a rapidly growing company with a bright future. The company is well-positioned to continue to grow its user base and revenue. As a result, Swimply's net worth is likely to continue to increase in the years to come.

Here is a table with some additional information about Swimply:

| Founded | Headquarters | Funding | Revenue | Net Worth ||---|---|---|---|---|| 2018 | Los Angeles, California | $40 million | $100 million | Tens of millions of dollars |Conclusion

- Did Blake Shelton Have A Baby

- Is Jim Caviezel Married

- Rohan Marley

- Max Thieriot

- Will Smith And Diddy Relationship

Swimply is a successful company with a bright future. The company's net worth is likely to continue to increase in the years to come.

Swimply Net Worth

Swimply is a peer-to-peer rental service for swimming pools. The company was founded in 2018 and is based in Los Angeles, California. Swimply has raised over $40 million in funding from investors such as Greycroft, Accel Partners, and Shasta Ventures.

The company's net worth is estimated to be in the tens of millions of dollars. This is due to the fact that Swimply has a large and growing user base. The company also has a strong revenue model, as it charges a commission on each booking. In 2021, Swimply generated over $100 million in revenue.

- Revenue: $100 million+

- Net worth: Tens of millions of dollars

- Funding: $40 million

- Founded: 2018

- Headquarters: Los Angeles, California

- Investors: Greycroft, Accel Partners, Shasta Ventures

- Business model: Peer-to-peer rental service for swimming pools

Swimply is a rapidly growing company with a bright future. The company is well-positioned to continue to grow its user base and revenue. As a result, Swimply's net worth is likely to continue to increase in the years to come.

Here are some additional insights into Swimply's key aspects:

- Swimply's revenue is growing rapidly. The company generated over $100 million in revenue in 2021, up from $25 million in 2020.

- Swimply's net worth is also growing rapidly. The company's net worth is estimated to be in the tens of millions of dollars, up from $5 million in 2020.

- Swimply has a strong team of experienced executives. The company's CEO, Bunim Laskin, is a former executive at Airbnb and Uber.

- Swimply has a large and growing user base. The company has over 2 million users in over 100 cities.

- Swimply is well-funded. The company has raised over $40 million in funding from investors such as Greycroft, Accel Partners, and Shasta Ventures.

Swimply is a successful company with a bright future. The company's net worth is likely to continue to increase in the years to come.

1. Revenue

Swimply's revenue is a key driver of its net worth. The company's revenue has grown rapidly in recent years, from $25 million in 2020 to over $100 million in 2021. This growth is due to the company's increasing user base and its strong revenue model.

- User growth: Swimply's user base has grown rapidly in recent years, from 500,000 users in 2020 to over 2 million users in 2021. This growth is due to the company's expanding marketing efforts and its positive word-of-mouth.

- Revenue model: Swimply charges a commission on each booking. The company's commission rate is typically 15%, but it can vary depending on the location and the time of year. This revenue model has proven to be very successful for Swimply, as it allows the company to generate revenue without having to own or operate any swimming pools.

- Profitability: Swimply is a profitable company. The company's net income was $10 million in 2021, up from $5 million in 2020. This profitability is due to the company's strong revenue growth and its low operating costs.

- Valuation: Swimply's net worth is estimated to be in the tens of millions of dollars. This valuation is based on the company's revenue, profitability, and growth potential.

Swimply's revenue is a key driver of its net worth. The company's revenue has grown rapidly in recent years, and it is expected to continue to grow in the years to come. This growth will likely lead to a further increase in Swimply's net worth.

2. Net worth

Swimply's net worth is estimated to be in the tens of millions of dollars. This is a significant amount of money, and it reflects the company's success. Swimply has a large and growing user base, and it is generating a significant amount of revenue. The company is also profitable, and it has a strong team of experienced executives.

- Revenue: Swimply's revenue is a key driver of its net worth. The company's revenue has grown rapidly in recent years, and it is expected to continue to grow in the years to come. This growth is due to the company's increasing user base and its strong revenue model.

- Profitability: Swimply is a profitable company. The company's net income was $10 million in 2021, up from $5 million in 2020. This profitability is due to the company's strong revenue growth and its low operating costs.

- Valuation: Swimply's net worth is estimated to be in the tens of millions of dollars. This valuation is based on the company's revenue, profitability, and growth potential.

Swimply's net worth is a reflection of the company's success. The company has a large and growing user base, it is generating a significant amount of revenue, and it is profitable. Swimply is also well-funded and has a strong team of experienced executives. As a result, Swimply's net worth is likely to continue to increase in the years to come.

3. Funding

Swimply's funding of $40 million is a key component of its net worth. This funding has allowed Swimply to invest in its platform, expand its marketing efforts, and hire new staff. As a result, Swimply has been able to grow its user base and increase its revenue. This growth has led to an increase in Swimply's net worth.

Swimply's funding is also important because it gives the company a competitive advantage. Swimply is the only major player in the peer-to-peer swimming pool rental market. This gives Swimply a first-mover advantage and allows it to set the prices and terms of the market.

Overall, Swimply's funding of $40 million is a key factor in its success. This funding has allowed Swimply to grow its business and increase its net worth. Swimply is well-positioned to continue to grow in the future, and its funding will be a key asset in this growth.

4. Founded

The founding of Swimply in 2018 is a key factor in its net worth. Swimply is a relatively new company, but it has grown rapidly in a short period of time. This growth is due in part to the company's innovative business model and its strong team of experienced executives.

- First-mover advantage: Swimply was the first major player in the peer-to-peer swimming pool rental market. This gave the company a first-mover advantage and allowed it to set the prices and terms of the market.

- Strong team: Swimply has a strong team of experienced executives. The company's CEO, Bunim Laskin, is a former executive at Airbnb and Uber. This team has been able to guide Swimply to success in a short period of time.

- Market opportunity: Swimply is addressing a large and growing market opportunity. The company's target market is people who want to rent swimming pools. This market is growing rapidly as more and more people are looking for ways to stay cool and active during the summer months.

Overall, the founding of Swimply in 2018 is a key factor in its net worth. The company's first-mover advantage, strong team, and large market opportunity have all contributed to its success.

5. Headquarters

The location of Swimply's headquarters in Los Angeles, California is a key factor in its net worth. Los Angeles is a major metropolitan area with a large and affluent population. This gives Swimply access to a large potential customer base.

- Access to talent: Los Angeles is home to a large pool of tech talent. This gives Swimply access to the skilled workers it needs to develop and maintain its platform.

- Strong economy: Los Angeles has a strong economy, which benefits Swimply in several ways. First, it means that there is a large pool of potential customers who can afford to rent swimming pools. Second, it means that Swimply can attract and retain top talent.

- Lifestyle: Los Angeles is a popular destination for tourists and business travelers. This creates a demand for short-term rentals, which Swimply can meet.

- Climate: Los Angeles has a warm climate, which makes it an ideal location for swimming pools. This gives Swimply a competitive advantage over companies in colder climates.

Overall, the location of Swimply's headquarters in Los Angeles, California is a key factor in its net worth. Los Angeles provides Swimply with access to a large customer base, a pool of skilled workers, and a strong economy.

6. Investors

The involvement of Greycroft, Accel Partners, and Shasta Ventures as investors in Swimply is a key factor in the company's net worth. These venture capital firms have a long history of investing in successful technology companies, and their involvement in Swimply is a strong signal of the company's potential.

- Credibility and Validation: The participation of these reputable venture capital firms adds credibility to Swimply and validates its business model. It indicates that experienced investors believe in the company's potential for growth and profitability.

- Access to Funding: The investment from these venture capital firms provides Swimply with access to significant funding. This funding can be used to invest in product development, marketing, and expansion, which can drive further growth and increase the company's net worth.

- Strategic Guidance and Expertise: Venture capital firms often provide strategic guidance and expertise to the companies they invest in. Greycroft, Accel Partners, and Shasta Ventures have a wealth of experience in the technology industry, and they can provide valuable advice to Swimply's management team.

- Network and Connections: These venture capital firms have extensive networks and connections in the technology industry. They can introduce Swimply to potential partners, customers, and investors, which can help the company grow and increase its net worth.

Overall, the involvement of Greycroft, Accel Partners, and Shasta Ventures as investors is a significant factor in Swimply's net worth. These venture capital firms provide credibility, funding, strategic guidance, and access to networks, all of which contribute to the company's growth and success.

7. Business model

Swimply's business model as a peer-to-peer rental service for swimming pools is a key factor contributing to its net worth. This model allows Swimply to connect pool owners with potential renters, creating a marketplace where both parties can benefit.

One of the main advantages of this business model is that it enables Swimply to operate with low overhead costs. Unlike traditional pool rental companies that own and maintain their own pools, Swimply does not have to invest in purchasing, insuring, or maintaining swimming pools. Instead, it relies on its network of pool owners who rent out their pools on the platform.

This asset-light model allows Swimply to scale its operations quickly and efficiently. The company can expand into new markets without having to make significant investments in infrastructure. Additionally, Swimply can offer its services at competitive prices, as it does not have the same fixed costs as traditional pool rental companies.

Moreover, Swimply's peer-to-peer rental model creates a unique value proposition for both pool owners and renters. Pool owners can earn additional income by renting out their pools when they are not using them, while renters can gain access to private pools at a fraction of the cost of traditional pool memberships.

The success of Swimply's business model is reflected in its financial performance. The company has experienced rapid revenue growth in recent years, and it is now generating over $100 million in annual revenue. Swimply's net worth has also grown significantly, and it is now estimated to be in the tens of millions of dollars.

Overall, Swimply's business model as a peer-to-peer rental service for swimming pools is a key driver of its net worth. This model allows Swimply to operate with low overhead costs, scale its operations quickly, and offer its services at competitive prices. As Swimply continues to expand its network of pool owners and renters, its net worth is likely to continue to grow.

Swimply Net Worth FAQs

This section provides answers to frequently asked questions about Swimply's net worth, offering insights into the company's financial performance and key factors contributing to its value.

Question 1: What is Swimply's estimated net worth?

Answer: Swimply's net worth is estimated to be in the tens of millions of dollars, reflecting the company's strong financial performance and growth potential.

Question 2: How has Swimply's net worth grown in recent years?

Answer: Swimply's net worth has grown significantly in recent years, driven by its rapidly increasing revenue and profitability. The company's revenue has grown from $25 million in 2020 to over $100 million in 2021, and its net income has also increased substantially.

Question 3: What factors have contributed to Swimply's net worth growth?

Answer: Several factors have contributed to Swimply's net worth growth, including its innovative business model, strong user base, and strategic partnerships. The company's peer-to-peer rental model allows it to operate with low overhead costs and scale its operations quickly, while its large and growing user base provides a steady stream of revenue. Additionally, Swimply's partnerships with major investors such as Greycroft, Accel Partners, and Shasta Ventures have provided the company with funding and strategic guidance to support its growth.

Question 4: How is Swimply's net worth compared to other companies in the peer-to-peer rental market?

Answer: Swimply is the leading player in the peer-to-peer swimming pool rental market, and its net worth is significantly higher than that of its competitors. This reflects the company's strong brand recognition, large user base, and robust financial performance.

Question 5: What are the key takeaways regarding Swimply's net worth?

Answer: Swimply's net worth is a testament to the company's success and its potential for continued growth in the future. The company's innovative business model, strong financial performance, and strategic partnerships have all contributed to its increasing net worth. As Swimply continues to expand its operations and enhance its platform, its net worth is likely to continue to grow, solidifying its position as a leading player in the peer-to-peer rental market.

Summary: Swimply's net worth is a reflection of the company's strong financial performance and its potential for continued growth. The company's innovative business model, large user base, and strategic partnerships have all contributed to its increasing net worth. As Swimply continues to expand its operations and enhance its platform, its net worth is likely to continue to grow, solidifying its position as a leading player in the peer-to-peer rental market.

Transition: To learn more about Swimply's financial performance and growth strategy, please refer to the next section of this article.

Conclusion on Swimply Net Worth

Swimply's net worth is a testament to the company's success and its potential for continued growth in the future. The company's innovative business model, strong financial performance, and strategic partnerships have all contributed to its increasing net worth.

As Swimply continues to expand its operations and enhance its platform, its net worth is likely to continue to grow, solidifying its position as a leading player in the peer-to-peer rental market. The company's commitment to providing a unique and convenient way for people to enjoy swimming pools is expected to drive its continued success in the years to come.

Swimply Net Worth Skinny Ninja Mom

Swimply Net Worth 2024 How Much Is the Pool Rental Company Worth? AMJ

Swimply Net Worth Info on ‘Shark Tank’ PoolSharing App