A Comprehensive Guide To Finding Bank Branch Numbers

What is a branch number for a bank?

A branch number is a unique identifier assigned to each physical location of a bank. It is used to identify the specific branch where an account is held or a transaction is taking place. Branch numbers are typically used in conjunction with other account information, such as the account number and routing number, to ensure that funds are transferred correctly.

Branch numbers are important because they help to ensure that financial transactions are processed accurately and efficiently. They also allow banks to track customer activity and identify any potential fraud or suspicious activity.

- Travis Van Winkle

- Luke Newton

- Choi Jin Hyuk Wife

- Mike Lindell Net Worth 2024

- Matthew Hussey Wife Audrey Age

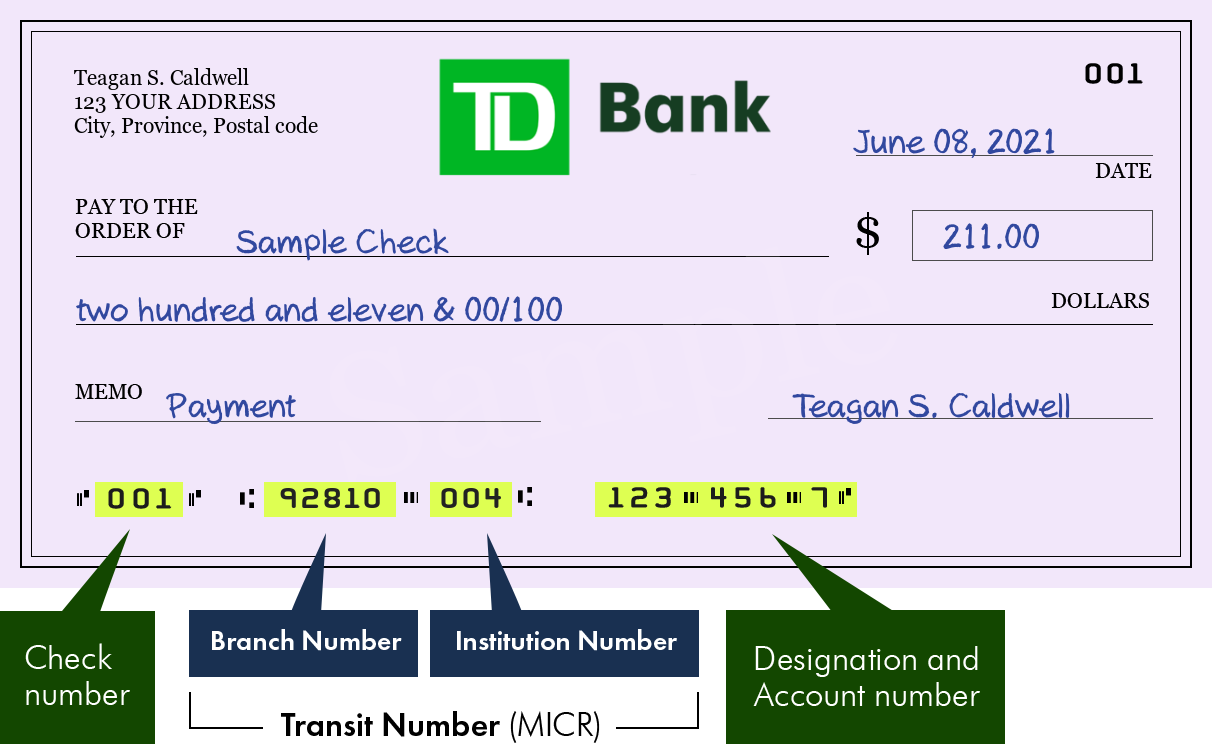

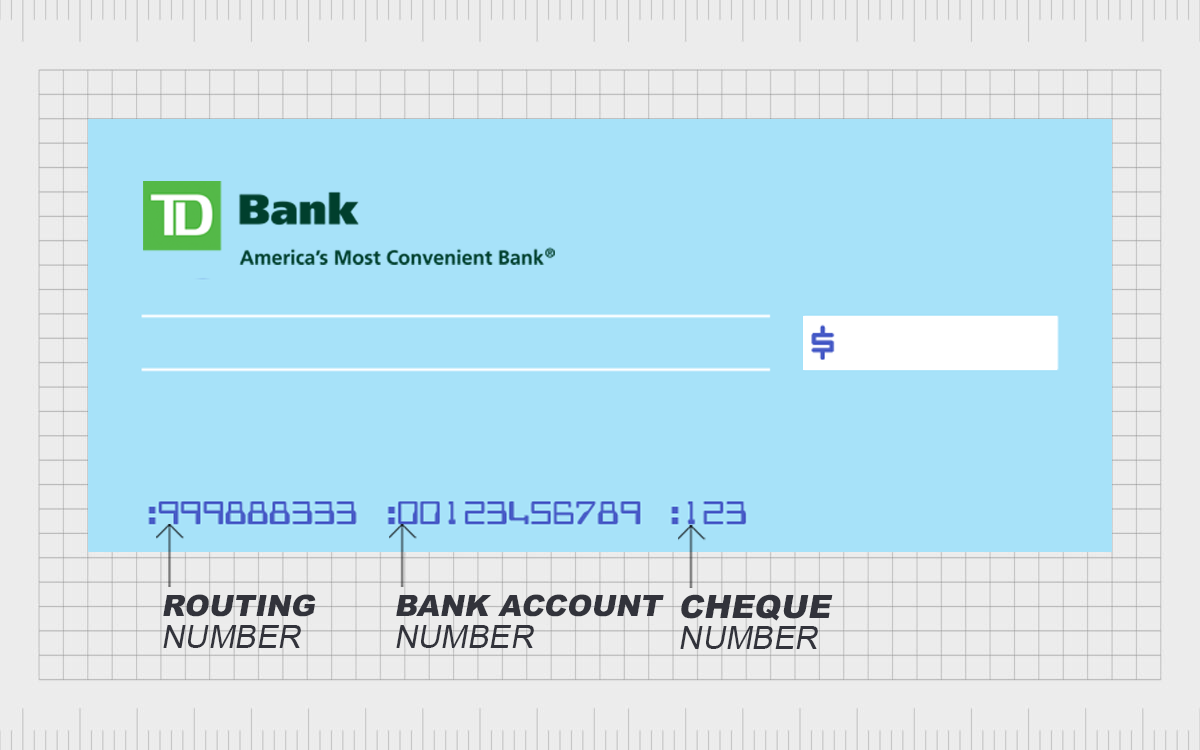

To find the branch number for your bank, you can typically find it on your bank statement or check. You can also contact your bank directly to obtain the branch number for a specific location.

Here are some of the benefits of using branch numbers:

- Ensures accurate and efficient processing of financial transactions

- Helps banks to track customer activity and identify any potential fraud or suspicious activity

- Provides a convenient way to identify the specific branch where an account is held or a transaction is taking place

Branch numbers are an important part of the banking system. They help to ensure that financial transactions are processed accurately and efficiently, and they also provide a convenient way to identify the specific branch where an account is held or a transaction is taking place.

Branch Number for Bank

A branch number is a unique identifier assigned to each physical location of a bank. It is used to identify the specific branch where an account is held or a transaction is taking place.

- Identification: Branch numbers help identify the specific branch of a bank.

- Transaction Processing: They facilitate accurate and efficient processing of financial transactions.

- Fraud Prevention: Branch numbers assist in tracking customer activity and detecting suspicious transactions.

- Customer Convenience: They provide a convenient way for customers to locate the branch associated with their accounts.

- Account Management: Branch numbers are essential for managing accounts at specific branches.

- Inter-Branch Transfers: They enable seamless transfer of funds between branches of the same bank.

In conclusion, branch numbers play a crucial role in the banking system. They ensure accurate transaction processing, prevent fraud, provide customer convenience, support account management, and facilitate inter-branch transfers. Understanding these aspects is essential for effective banking operations and customer satisfaction.

1. Identification

Branch numbers serve as unique identifiers for each physical location of a bank. They play a critical role in identifying the specific branch where an account is held or a transaction takes place. This identification process is essential for several reasons:

- Accurate Transaction Processing: Branch numbers ensure that financial transactions are processed accurately and efficiently. By identifying the specific branch involved, banks can correctly route and process transactions, reducing errors and delays.

- Fraud Prevention: Branch numbers assist in detecting and preventing fraudulent activities. When a transaction is initiated, the branch number helps banks verify the authenticity of the request and identify any suspicious patterns or inconsistencies that may indicate fraud.

- Customer Convenience: Branch numbers provide customers with a convenient way to locate and identify the branch associated with their accounts. This information is vital for tasks such as cash withdrawals, deposits, and account inquiries, allowing customers to easily access their banking services at the correct location.

- Account Management: Branch numbers facilitate effective account management for customers. By identifying the specific branch, customers can direct inquiries, requests, and account updates to the appropriate location, ensuring timely and accurate responses.

In summary, the identification function of branch numbers is crucial for the smooth operation of banking services. It enables accurate transaction processing, fraud prevention, customer convenience, and efficient account management, contributing to the overall security and reliability of the banking system.

2. Transaction Processing

Branch numbers play a pivotal role in ensuring the accuracy and efficiency of financial transactions within the banking system.

- Accurate Routing:

Branch numbers enable banks to accurately route transactions to the correct branch, ensuring timely processing and delivery of funds. This prevents delays, errors, and potential disruptions in the flow of financial transactions.

- Fraud Detection:

Branch numbers assist in detecting and preventing fraudulent activities. When a transaction is initiated, the branch number helps banks verify the authenticity of the request and identify any suspicious patterns or inconsistencies that may indicate fraud. This helps protect customers and safeguard the integrity of the banking system.

- Efficient Reconciliation:

Branch numbers facilitate efficient reconciliation of accounts and transactions. By identifying the specific branch involved in a transaction, banks can easily match and reconcile records, ensuring the accuracy and completeness of financial data. This helps maintain the integrity of accounting systems and provides a clear audit trail for regulatory and compliance purposes.

- Automated Processing:

Branch numbers enable automated processing of financial transactions, increasing efficiency and reducing the risk of errors. Automated systems rely on branch numbers to identify the appropriate accounts and route transactions accordingly, streamlining the process and minimizing the need for manual intervention.

In conclusion, the connection between "Transaction Processing: They facilitate accurate and efficient processing of financial transactions." and "branch number for bank" is vital for the smooth functioning of the banking system. Branch numbers ensure accurate routing, facilitate fraud detection, enable efficient reconciliation, and support automated processing, ultimately contributing to the reliability and security of financial transactions.

3. Fraud Prevention

Branch numbers play a critical role in fraud prevention within the banking system. They serve as a key identifier for tracking customer activity and detecting suspicious transactions that may indicate fraudulent behavior.

When a financial transaction is initiated, the branch number associated with the customer's account is used to verify the authenticity of the request. Banks maintain records of customer activity at each branch, allowing them to identify any unusual patterns or deviations from normal spending habits. This enables banks to flag suspicious transactions for further investigation and potential fraud prevention measures.

For example, if a customer typically makes small, regular transactions at their local branch and suddenly attempts to make a large, international transfer from a different branch, the bank's fraud detection systems may trigger an alert based on the change in transaction pattern and branch location. This allows the bank to investigate the transaction and take appropriate action to protect the customer's account.

In summary, branch numbers are an essential component of fraud prevention within the banking system. They enable banks to track customer activity, detect suspicious transactions, and take proactive measures to protect their customers from financial loss. Understanding the connection between "Fraud Prevention: Branch numbers assist in tracking customer activity and detecting suspicious transactions." and "branch number for bank" is crucial for maintaining the security and integrity of financial transactions.

4. Customer Convenience

Branch numbers play a pivotal role in customer convenience within the banking system. They serve as a key identifier for customers to easily locate the physical branch associated with their accounts, enabling them to access banking services and perform transactions efficiently.

Customers can use their branch number to find the nearest branch location, whether they need to make a deposit, withdraw cash, or speak to a bank representative in person. Branch numbers are typically displayed on bank statements, checks, and online banking platforms, providing easy access to this information for customers.

For instance, if a customer needs to deposit a check but is unfamiliar with the area, they can use their branch number to locate the nearest branch and complete the transaction conveniently. This eliminates the hassle of searching for a branch or calling the bank's customer service line for assistance.

In conclusion, branch numbers are an essential aspect of customer convenience in banking. They enable customers to easily locate their associated branch, ensuring quick and convenient access to banking services. Understanding the connection between "Customer Convenience: They provide a convenient way for customers to locate the branch associated with their accounts." and "branch number for bank" is crucial for banks to provide a positive and seamless customer experience.

5. Account Management

Branch numbers play a crucial role in account management within the banking system. They serve as a unique identifier for managing customer accounts at specific physical branches, allowing banks to efficiently process transactions, provide personalized services, and maintain accurate account records.

When a customer opens an account at a bank, they are typically assigned a branch number associated with the branch where the account is held. This branch number becomes an integral part of the customer's account information and is used for various account management purposes, including:

- Transaction Processing: Branch numbers facilitate the processing of transactions, such as deposits, withdrawals, and transfers, by identifying the specific branch where the transaction is taking place. This ensures accurate and timely processing of financial activities.

- Account Inquiries and Updates: Customers can use their branch number to make inquiries about their account balance, transaction history, and other account-related information. They can also visit the associated branch to make changes to their account, such as updating personal details or setting up automatic payments.

- Dispute Resolution: In case of any discrepancies or disputes related to an account, the branch number helps banks locate the relevant account records and investigate the issue promptly. This enables efficient resolution of customer concerns.

- Personalized Services: Branch numbers allow banks to provide personalized services to their customers. By identifying the branch where a customer primarily conducts their banking activities, banks can offer tailored financial solutions and advice that meet their specific needs.

In conclusion, branch numbers are an essential component of account management in banking. They facilitate efficient transaction processing, enable convenient account inquiries and updates, support dispute resolution, and allow banks to provide personalized services to their customers. Understanding the connection between "Account Management: Branch numbers are essential for managing accounts at specific branches." and "branch number for bank" is crucial for banks to maintain accurate account records, provide seamless account management services, and enhance the overall customer banking experience.

6. Inter-Branch Transfers

Branch numbers play a crucial role in facilitating seamless inter-branch transfers within a bank. These transfers allow customers to conveniently move funds between their accounts held at different branches of the same bank, ensuring efficient and timely movement of funds.

- Simplified Process:

Branch numbers streamline the inter-branch transfer process by providing a unique identifier for each branch. When initiating a transfer, customers simply need to specify the branch number of the recipient branch, ensuring that the funds are directed to the correct destination. - Accurate and Secure Transfers:

Branch numbers enhance the accuracy and security of inter-branch transfers. By verifying the branch number against the bank's records, the system ensures that the funds are transferred to the intended branch and account, minimizing the risk of errors or fraudulent activities. - Real-Time Processing:

In many cases, inter-branch transfers using branch numbers are processed in real-time, providing immediate access to funds for the recipient. This efficiency is particularly beneficial for urgent financial needs or time-sensitive transactions. - Reduced Transaction Fees:

Banks often offer reduced transaction fees or waivers for inter-branch transfers within the same bank. Branch numbers help banks identify these intra-bank transfers and apply the appropriate fee structure, providing cost savings for customers.

In conclusion, branch numbers are essential for enabling seamless and efficient inter-branch transfers. They simplify the process, enhance accuracy and security, facilitate real-time processing, and potentially reduce transaction fees. Understanding the connection between "Inter-Branch Transfers: They enable seamless transfer of funds between branches of the same bank." and "branch number for bank" highlights the critical role of branch numbers in facilitating convenient and secure movement of funds within a bank.

FAQs on Branch Number for Banks

Frequently asked questions (FAQs) regarding branch numbers for banks are addressed below to provide a comprehensive understanding of their significance and usage.

Question 1: What is a branch number for a bank?

Answer: A branch number is a unique identifier assigned to each physical location of a bank. It helps identify the specific branch where an account is held or a transaction takes place.

Question 2: Why is a branch number important?

Answer: Branch numbers play a crucial role in accurate transaction processing, fraud prevention, customer convenience, efficient account management, and seamless inter-branch transfers.

Question 3: How can I find the branch number for my bank?

Answer: The branch number can typically be found on your bank statement, check, or by contacting your bank directly.

Question 4: What are the benefits of using branch numbers?

Answer: Using branch numbers offers several benefits, including accurate and efficient financial transactions, enhanced fraud protection, convenient branch identification, streamlined account management, and simplified inter-branch transfers.

Question 5: How do branch numbers contribute to banking operations?

Answer: Branch numbers are essential for the smooth functioning of banking operations. They enable accurate transaction processing, facilitate fraud detection, provide customer convenience, support efficient account management, and ensure seamless inter-branch transfers.

Summary: Branch numbers are critical identifiers for bank branches, enabling efficient and secure banking operations. Understanding their significance and usage is vital for customers and banks alike.

Transition: For further insights into branch numbers for banks, please refer to the additional sections below.

Conclusion

The branch number for a bank plays a pivotal role in the efficient functioning of the banking system. It serves as a unique identifier for each physical location of a bank, enabling accurate transaction processing, fraud prevention, and efficient account management. Branch numbers provide convenience to customers by allowing them to easily identify the branch associated with their accounts and facilitate seamless inter-branch transfers.

Understanding the significance of branch numbers is essential for both banks and customers. Banks can leverage branch numbers to enhance their operational efficiency, while customers can benefit from the convenience and security it provides. The continued use of branch numbers in banking operations ensures the smooth flow of financial transactions and supports the overall stability of the financial system.

- Hunter Fieri

- Daniel Radcliffe Age In 2001

- Poonawalla Family

- Nle Choppa Sophie Rain Song

- Jake Harris From The Deadliest Catch

000492810 — Routing Number for the The Torontodominion Bank in Surrey

public bank branch code list Richard Howard

How to Find Updated TD Bank Routing Number (2024)