Definitive Guide To Bank Branch IDs: History, Significance, And Identification

What is a bank branch ID? A bank branch ID is a unique identifier for a specific branch of a bank. It is used to identify the branch when processing transactions, such as deposits, withdrawals, and transfers.

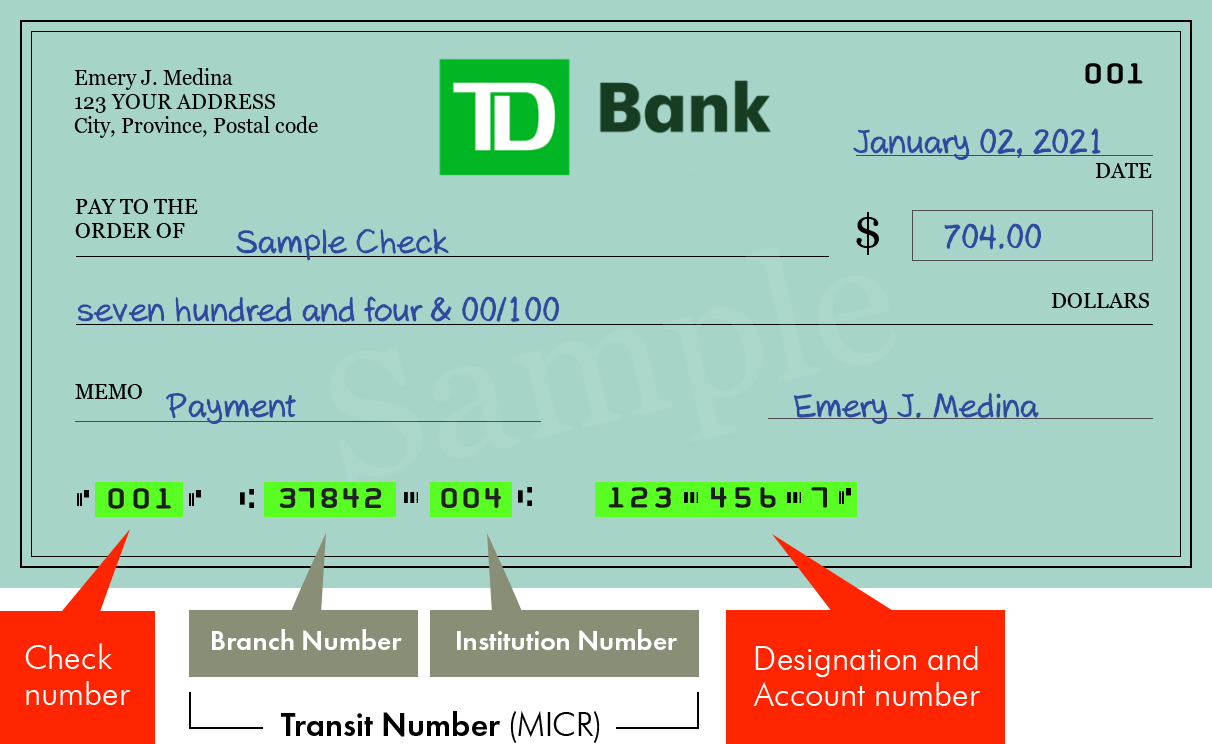

Each bank branch is assigned its own unique ID. This ID is typically a number, but it can also be a combination of letters and numbers. The ID is usually displayed on the bank's website, on bank statements, and on checks.

Bank branch IDs are important because they allow banks to track transactions and identify the branch where a transaction occurred. This information can be used to prevent fraud and to resolve disputes.

- Poonawalla Family

- Kirk Herbstreit Family Pic

- Is Neil Flynn Married

- Khabib Wife

- Brittany Mahomes Net Worth

Here are some of the benefits of using bank branch IDs:

- Prevents fraud

- Resolves disputes

- Tracks transactions

- Identifies the branch where a transaction occurred

Bank branch IDs have been used for many years. They are an important part of the banking system and help to ensure the security and efficiency of banking transactions.

Here are some additional details about bank branch IDs:

- Carrie Underwood

- Brandi Of Storage Wars

- Rory Feek Remarriage

- Sabrina Carpenter Transformation

- Anant Ambani Height Feet

- Bank branch IDs are typically assigned by the bank's head office.

- Bank branch IDs can change over time.

- Bank branch IDs are not the same as bank account numbers.

If you have any questions about bank branch IDs, please contact your bank.

Bank Branch ID

A bank branch ID is a unique identifier for a specific branch of a bank. It is used to identify the branch when processing transactions, such as deposits, withdrawals, and transfers.

- Unique identifier

- Specific branch

- Transaction processing

- Fraud prevention

- Dispute resolution

- Security and efficiency

Bank branch IDs are essential for the secure and efficient functioning of the banking system. They help to prevent fraud, resolve disputes, and track transactions. Each bank branch is assigned its own unique ID, which is typically a number or a combination of letters and numbers. This ID is displayed on the bank's website, on bank statements, and on checks.

When a customer makes a transaction, the bank branch ID is used to identify the branch where the transaction occurred. This information can be used to prevent fraud and to resolve disputes. For example, if a customer reports a fraudulent transaction, the bank can use the branch ID to identify the branch where the transaction occurred and to investigate the matter.

Bank branch IDs are also used to track transactions. This information can be used to identify trends and patterns, and to improve the efficiency of the banking system. For example, a bank may use transaction data to identify branches that are experiencing high levels of traffic and to adjust staffing levels accordingly.

Bank branch IDs are an important part of the banking system. They help to ensure the security and efficiency of banking transactions.

1. Unique identifier

A unique identifier is a value that is used to identify an entity uniquely. In the context of bank branch IDs, the unique identifier is the number or combination of letters and numbers that is assigned to a specific branch. This unique identifier is used to distinguish the branch from all other branches of the bank.

The unique identifier is an important component of a bank branch ID because it allows the bank to track transactions and identify the branch where a transaction occurred. This information can be used to prevent fraud, resolve disputes, and improve the efficiency of the banking system.

For example, if a customer reports a fraudulent transaction, the bank can use the unique identifier to identify the branch where the transaction occurred and to investigate the matter. The bank can also use the unique identifier to track transaction patterns and to identify branches that are experiencing high levels of traffic.

The unique identifier is a critical component of the bank branch ID system. It helps to ensure the security and efficiency of banking transactions.

2. Specific branch

A bank branch is a physical location where customers can conduct banking transactions. Each branch is assigned a unique identifier, known as a bank branch ID, which is used to distinguish it from all other branches of the bank.

- Identification

The bank branch ID is used to identify the specific branch where a transaction occurred. This information is important for fraud prevention and dispute resolution.

- Location

The bank branch ID can be used to determine the location of a specific branch. This information can be useful for customers who are looking for a branch that is close to their home or work.

- Services

The bank branch ID can be used to determine the services that are offered at a specific branch. This information can be useful for customers who are looking for a branch that offers specific services, such as foreign currency exchange or safe deposit boxes.

- Hours of operation

The bank branch ID can be used to determine the hours of operation for a specific branch. This information can be useful for customers who are planning to visit a branch.

The bank branch ID is an important piece of information that can be used to identify, locate, and learn more about a specific branch. Customers can use this information to find a branch that meets their needs and to plan their banking transactions.

3. Transaction processing

In the world of banking, transaction processing is the lifeblood of the industry. It is the process of capturing, recording, and processing financial transactions. Bank branch IDs play a vital role in this process, as they help to identify the branch where a transaction occurred. This information is critical for a variety of reasons, including fraud prevention, dispute resolution, and regulatory compliance.

- Fraud prevention

Bank branch IDs can help to prevent fraud by identifying the branch where a fraudulent transaction occurred. This information can be used to investigate the fraud and to take appropriate action, such as freezing the account or closing the branch.

- Dispute resolution

Bank branch IDs can also help to resolve disputes between customers and banks. For example, if a customer disputes a transaction, the bank can use the branch ID to identify the branch where the transaction occurred and to investigate the matter.

- Regulatory compliance

Bank branch IDs are also important for regulatory compliance. Banks are required to maintain records of all transactions, and the branch ID helps to ensure that these records are accurate and complete.

In short, bank branch IDs play a vital role in transaction processing. They help to prevent fraud, resolve disputes, and ensure regulatory compliance. Without bank branch IDs, the banking system would be much less efficient and secure.

4. Fraud prevention

Fraud prevention is a critical component of bank branch id. By identifying the branch where a transaction occurred, bank branch ids help banks to prevent fraud in a number of ways:

- Identifying suspicious activity: Banks can use bank branch ids to identify suspicious activity, such as large withdrawals from a branch that is not typically used by the customer.

- Investigating fraud: If fraud does occur, bank branch ids can help banks to investigate the fraud and to identify the perpetrators.

- Preventing future fraud: Banks can use bank branch ids to prevent future fraud by identifying branches that are at high risk for fraud and by taking steps to mitigate that risk.

Bank branch ids are an important tool in the fight against fraud. By helping banks to identify, investigate, and prevent fraud, bank branch ids help to protect customers and the financial system.

Here are some real-life examples of how bank branch ids have been used to prevent fraud:

- In 2019, a bank used bank branch ids to identify a fraudulent scheme in which criminals were using stolen credit cards to make purchases at branches across the country.

- In 2020, a bank used bank branch ids to investigate a case of identity theft in which a criminal had opened a bank account in the victim's name and was using the account to make fraudulent withdrawals.

- In 2021, a bank used bank branch ids to prevent a fraudster from withdrawing money from a customer's account by identifying the branch where the fraudster was attempting to make the withdrawal and freezing the account.

These are just a few examples of how bank branch ids are used to prevent fraud. By helping banks to identify, investigate, and prevent fraud, bank branch ids help to protect customers and the financial system.

5. Dispute resolution

Dispute resolution is an important component of bank branch id. By identifying the branch where a transaction occurred, bank branch ids help banks to resolve disputes between customers and the bank in a number of ways:

- Identifying the facts: Bank branch ids can help banks to identify the facts of a dispute, such as the date and time of the transaction, the amount of money involved, and the parties involved.

- Investigating the dispute: Bank branch ids can help banks to investigate a dispute and to determine the cause of the dispute.

- Resolving the dispute: Bank branch ids can help banks to resolve a dispute by identifying a solution that is fair to both the customer and the bank.

Bank branch ids are an important tool in the dispute resolution process. By helping banks to identify, investigate, and resolve disputes, bank branch ids help to protect customers and the financial system.

Here are some real-life examples of how bank branch ids have been used to resolve disputes:

- In 2019, a customer disputed a transaction that was made at a branch that they did not recognize. The bank used the bank branch id to identify the branch where the transaction occurred and to investigate the matter. The bank determined that the transaction was fraudulent and credited the customer's account for the amount of the transaction.

- In 2020, a customer disputed a fee that was charged to their account. The bank used the bank branch id to identify the branch where the fee was charged and to investigate the matter. The bank determined that the fee was charged in error and refunded the customer the amount of the fee.

- In 2021, a customer disputed a check that was cashed at a branch that they did not recognize. The bank used the bank branch id to identify the branch where the check was cashed and to investigate the matter. The bank determined that the check was forged and reimbursed the customer for the amount of the check.

These are just a few examples of how bank branch ids are used to resolve disputes. By helping banks to identify, investigate, and resolve disputes, bank branch ids help to protect customers and the financial system.

6. Security and efficiency

Bank branch IDs play a vital role in maintaining the security and efficiency of the banking system. By uniquely identifying each branch, bank branch IDs help banks to prevent fraud, resolve disputes, and track transactions.

- Fraud prevention

Bank branch IDs can help to prevent fraud by identifying the branch where a fraudulent transaction occurred. This information can be used to investigate the fraud and to take appropriate action, such as freezing the account or closing the branch.

- Dispute resolution

Bank branch IDs can also help to resolve disputes between customers and banks. For example, if a customer disputes a transaction, the bank can use the branch ID to identify the branch where the transaction occurred and to investigate the matter.

- Transaction tracking

Bank branch IDs can also be used to track transactions. This information can be used to identify trends and patterns, and to improve the efficiency of the banking system. For example, a bank may use transaction data to identify branches that are experiencing high levels of traffic and to adjust staffing levels accordingly.

- Compliance

Bank branch IDs are also important for compliance with regulations. Banks are required to maintain records of all transactions, and the branch ID helps to ensure that these records are accurate and complete.

In short, bank branch IDs are essential for the security and efficiency of the banking system. They help to prevent fraud, resolve disputes, track transactions, and ensure compliance with regulations.

FAQs about Bank Branch IDs

Bank branch IDs are unique identifiers for specific branches of a bank. They are used to identify the branch when processing transactions, such as deposits, withdrawals, and transfers. Bank branch IDs are important because they help to prevent fraud, resolve disputes, and track transactions.

Question 1: What is a bank branch ID?

Answer: A bank branch ID is a unique identifier for a specific branch of a bank. It is used to identify the branch when processing transactions, such as deposits, withdrawals, and transfers.

Question 2: Why are bank branch IDs important?

Answer: Bank branch IDs are important because they help to prevent fraud, resolve disputes, and track transactions.

Question 3: How can bank branch IDs help prevent fraud?

Answer: Bank branch IDs can help prevent fraud by identifying the branch where a fraudulent transaction occurred. This information can be used to investigate the fraud and to take appropriate action, such as freezing the account or closing the branch.

Question 4: How can bank branch IDs help resolve disputes?

Answer: Bank branch IDs can also help to resolve disputes between customers and banks. For example, if a customer disputes a transaction, the bank can use the branch ID to identify the branch where the transaction occurred and to investigate the matter.

Question 5: How can bank branch IDs help track transactions?

Answer: Bank branch IDs can also be used to track transactions. This information can be used to identify trends and patterns, and to improve the efficiency of the banking system.

Summary: Bank branch IDs are an important part of the banking system. They help to prevent fraud, resolve disputes, and track transactions. Customers can use bank branch IDs to identify the branch where they conducted a transaction and to contact the bank if they have any questions or concerns.

Transition to the next article section: For more information about bank branch IDs, please visit our website or contact your bank.

Conclusion

A bank branch ID is a unique identifier for a specific branch of a bank. It is used to identify the branch when processing transactions, such as deposits, withdrawals, and transfers. Bank branch IDs are important because they help to prevent fraud, resolve disputes, and track transactions.

In conclusion, bank branch IDs are an essential part of the banking system. They help to ensure the security and efficiency of banking transactions. Customers should be aware of their bank branch ID and should use it when conducting banking transactions.

What does a BIN number look like? Leia aqui How many digits is a BIN

Td Bank Swift Code

Canara Bank Net banking This user Id already exists please contact