Find The Right Bank And Branch Number For Your Transaction

What is a bank and branch number?

A bank and branch number is a unique identifier assigned to each branch of a bank. It is used to identify the specific branch where an account is held or a transaction is taking place.

Bank and branch numbers are typically used in conjunction with account numbers to facilitate electronic fund transfers, such as direct deposits and wire transfers. They can also be used to identify the branch where a customer can make deposits, withdrawals, or other transactions in person.

Bank and branch numbers are important because they help to ensure that financial transactions are processed accurately and securely. They also help banks to track and manage their accounts and branches.

Bank and Branch Number

Bank and branch numbers are essential components of the financial system, playing a crucial role in the processing and management of financial transactions.

- Identification: Uniquely identifies each branch of a bank.

- Transaction Processing: Facilitates electronic fund transfers, including direct deposits and wire transfers.

- Account Management: Helps banks track and manage their accounts and branches.

- Security: Contributes to the accurate and secure processing of financial transactions.

- Convenience: Enables customers to identify the branch where they can conduct transactions in person.

- Compliance: Adherence to regulatory requirements for financial institutions.

In conclusion, bank and branch numbers are essential aspects of the banking system, providing a secure and efficient framework for financial transactions. They serve as unique identifiers for branches, facilitate electronic fund transfers, aid in account management, enhance security, offer convenience to customers, and ensure compliance with regulatory requirements. Understanding these key aspects is crucial for navigating the financial landscape and conducting transactions effectively.

1. Identification

Bank and branch numbers play a vital role in identifying each branch of a bank uniquely. This identification is crucial for several reasons:

- Accurate Transaction Processing: Bank and branch numbers ensure that financial transactions are processed accurately. They help identify the specific branch where an account is held or a transaction is taking place, preventing errors and ensuring funds are directed to the correct destination.

- Efficient Fund Transfers: In the case of electronic fund transfers, such as direct deposits and wire transfers, bank and branch numbers facilitate efficient and timely processing. They enable banks to identify the recipient branch accurately, ensuring funds are credited to the intended account without delays.

- Branch-Specific Services: Bank and branch numbers allow customers to identify the branches where they can access specific services or conduct transactions. For instance, a customer may need to visit a branch with specialized services such as wealth management or foreign exchange.

- Fraud Prevention: Bank and branch numbers contribute to fraud prevention by providing an additional layer of security. Verifying the bank and branch number associated with a transaction helps banks identify and prevent unauthorized or fraudulent activities.

In summary, the identification aspect of bank and branch numbers is essential for accurate transaction processing, efficient fund transfers, convenient access to branch services, and fraud prevention. Understanding this connection is crucial for businesses and individuals to navigate the financial system effectively and securely.

2. Transaction Processing

Bank and branch numbers play a crucial role in the efficient and accurate processing of electronic fund transfers (EFTs), including direct deposits and wire transfers. EFTs have become increasingly prevalent in today's digital age, offering convenience, speed, and security for businesses and individuals alike.

When an EFT is initiated, the bank and branch number associated with the recipient's account is essential for ensuring that the funds are directed to the correct destination. The bank and branch number act as unique identifiers, enabling the sending and receiving banks to communicate and facilitate the transfer securely and seamlessly.

Direct deposits, such as salary payments and government benefits, rely on bank and branch numbers to ensure that funds are credited to the intended accounts on time. Similarly, wire transfers, which involve the electronic transfer of funds between different banks or financial institutions, require accurate bank and branch numbers to complete the transaction successfully.

Understanding the connection between bank and branch numbers and EFT processing is crucial for businesses and individuals who rely on electronic fund transfers. By providing accurate and up-to-date bank and branch information, they can ensure that their transactions are processed efficiently, securely, and without delays.

3. Account Management

Bank and branch numbers are essential for banks to track and manage their accounts and branches effectively. They provide a unique identifier for each branch, enabling banks to:

- Consolidate Financial Data: Bank and branch numbers allow banks to consolidate financial data from different branches into a centralized system. This helps them gain a comprehensive view of their overall financial performance and make informed decisions.

- Monitor Branch Performance: By tracking the performance of each branch, banks can identify areas for improvement and allocate resources accordingly. Bank and branch numbers help them analyze factors such as revenue generation, customer satisfaction, and operational efficiency.

- Manage Branch Networks: Bank and branch numbers facilitate the management of branch networks. Banks can track the number of branches in different locations, optimize branch distribution, and make strategic decisions about branch openings or closures.

- Enhance Risk Management: Bank and branch numbers aid in risk management by providing a clear understanding of the financial activities associated with each branch. This information helps banks identify potential risks, implement appropriate controls, and mitigate losses.

In summary, bank and branch numbers are crucial for banks to track and manage their accounts and branches. They provide a comprehensive view of financial performance, enable monitoring of branch operations, facilitate management of branch networks, and enhance risk management.

4. Security

Bank and branch numbers play a crucial role in ensuring the security and accuracy of financial transactions by:

- Authentication: When initiating electronic fund transfers, bank and branch numbers help authenticate the sender's account. This measure reduces the risk of unauthorized transactions and protects against fraud.

- Verification: Bank and branch numbers enable banks to verify the legitimacy of transactions. By matching the bank and branch number associated with the recipient's account, banks can confirm that the funds are being sent to the intended destination.

- Fraud Detection: Bank and branch numbers aid in fraud detection by providing an additional layer of security. If a transaction is attempted using an incorrect or invalid bank or branch number, it can be flagged as suspicious and investigated promptly.

- Compliance: Bank and branch numbers contribute to compliance with regulatory requirements. Financial institutions are obligated to implement measures to prevent money laundering and other illegal activities. Bank and branch numbers assist in identifying and reporting suspicious transactions.

In summary, bank and branch numbers play a vital role in the security and accuracy of financial transactions. They help authenticate transactions, verify legitimacy, detect fraud, ensure compliance, and protect against unauthorized access. Understanding the connection between bank and branch numbers and security is essential for businesses and individuals to safeguard their financial assets and maintain trust in the financial system.

5. Convenience

Bank and branch numbers provide convenience to customers by enabling them to identify the physical location where they can conduct transactions in person. This is particularly important for individuals who prefer face-to-face interactions or require specific services that may not be available through online or mobile banking.

For example, customers may visit a branch to:

- Deposit or withdraw large sums of cash

- Open new accounts or apply for loans

- Access safety deposit boxes

- Receive personalized financial advice

- Resolve complex banking issues

By providing customers with a clear understanding of which branch to visit based on their specific needs, bank and branch numbers enhance the overall banking experience. This convenience is particularly valuable for individuals who may not have easy access to online or mobile banking services or prefer the security and assurance of in-person transactions.

Furthermore, bank and branch numbers contribute to financial inclusion by ensuring that customers have access to physical banking services, regardless of their location or technological capabilities. This is especially important for underserved communities or individuals who may have limited access to digital banking options.

In summary, the convenience aspect of bank and branch numbers plays a vital role in meeting the needs of customers who prefer or require in-person banking services. By enabling customers to easily identify the branch where they can conduct transactions, banks can enhance customer satisfaction and provide a more comprehensive banking experience.

6. Compliance

Compliance with regulatory requirements is a crucial aspect of bank and branch operations. Bank and branch numbers play a significant role in ensuring that financial institutions adhere to these regulations and maintain the integrity of the financial system. By assigning unique identifiers to each branch, bank and branch numbers facilitate regulatory oversight and enable banks to:

- Comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Bank and branch numbers help banks identify and verify the identity of their customers, monitor transactions for suspicious activities, and report any potential money laundering or terrorist financing concerns to the appropriate authorities.

- Meet Capital Adequacy Requirements: Bank and branch numbers assist banks in calculating and maintaining the required capital ratios set by regulatory bodies. This ensures that banks have sufficient financial resources to absorb potential losses and continue operating safely and soundly.

- Facilitate Regulatory Reporting: Bank and branch numbers enable banks to accurately report their financial activities to regulatory authorities. This information is used to assess the overall health of the banking sector and identify any systemic risks.

- Enhance Risk Management: By tracking transactions and activities associated with each branch, bank and branch numbers help banks identify and mitigate potential risks. This includes risks related to fraud, operational errors, and compliance breaches.

Understanding the connection between compliance and bank and branch numbers is essential for financial institutions to operate responsibly and maintain public trust. By adhering to regulatory requirements, banks can prevent financial crimes, protect customer information, and contribute to the stability of the financial system.

FAQs on Bank and Branch Numbers

This section provides answers to frequently asked questions (FAQs) on bank and branch numbers to enhance your understanding of their significance in the financial system.

Question 1: What is the purpose of a bank and branch number?

Answer: Bank and branch numbers serve as unique identifiers for each branch of a bank. They facilitate accurate transaction processing, efficient electronic fund transfers, and effective account management.

Question 2: Why are bank and branch numbers important for electronic fund transfers?

Answer: Bank and branch numbers ensure that electronic fund transfers, such as direct deposits and wire transfers, are processed accurately and securely. They help identify the specific branch where the recipient account is held, ensuring funds are directed to the correct destination.

Question 3: How do bank and branch numbers contribute to account management?

Answer: Bank and branch numbers assist banks in tracking and managing their accounts and branches efficiently. They enable banks to consolidate financial data, monitor branch performance, manage branch networks, and enhance risk management.

Question 4: What role do bank and branch numbers play in security?

Answer: Bank and branch numbers contribute to the security and accuracy of financial transactions. They help authenticate transactions, verify legitimacy, detect fraud, ensure compliance with regulatory requirements, and protect against unauthorized access.

Question 5: How do bank and branch numbers enhance convenience for customers?

Answer: Bank and branch numbers provide convenience to customers by enabling them to identify the physical location where they can conduct transactions in person. This facilitates access to banking services, including cash deposits and withdrawals, account openings, loan applications, and personalized financial advice.

Summary: Bank and branch numbers are essential elements of the financial system, serving multiple purposes such as identification, transaction processing, account management, security, and customer convenience. Understanding their significance is crucial for effective participation in the financial landscape.

Transition: To further explore the relevance of bank and branch numbers, the next section will discuss their historical context and evolution in the banking industry.

Conclusion

In conclusion, bank and branch numbers play a pivotal role in the financial system, facilitating secure and efficient transactions, effective account management, and convenient customer interactions. Their unique identification of bank branches enables accurate transaction processing, streamlined electronic fund transfers, and comprehensive account management for banks.

Beyond their functional significance, bank and branch numbers contribute to the security and integrity of the financial system. They aid in fraud prevention, compliance with regulatory requirements, and risk management. By providing a clear and verifiable link between financial transactions and specific bank branches, bank and branch numbers enhance trust and confidence in the banking industry.

As the financial landscape continues to evolve, bank and branch numbers will remain essential elements for conducting banking activities, both traditional and digital. Their continued importance underscores their fundamental role in maintaining a stable, secure, and accessible financial system for businesses and individuals alike.

- Is Neil Flynn Married

- Jason Momoa

- Will Smith And Diddy Relationship

- George Clooney Kids

- Laura Govan Height

Home Bank Routing Numbers and Transit (Branch) Numbers

How to find your Bank Routing Number in Canada [2024] Protect Your Wealth

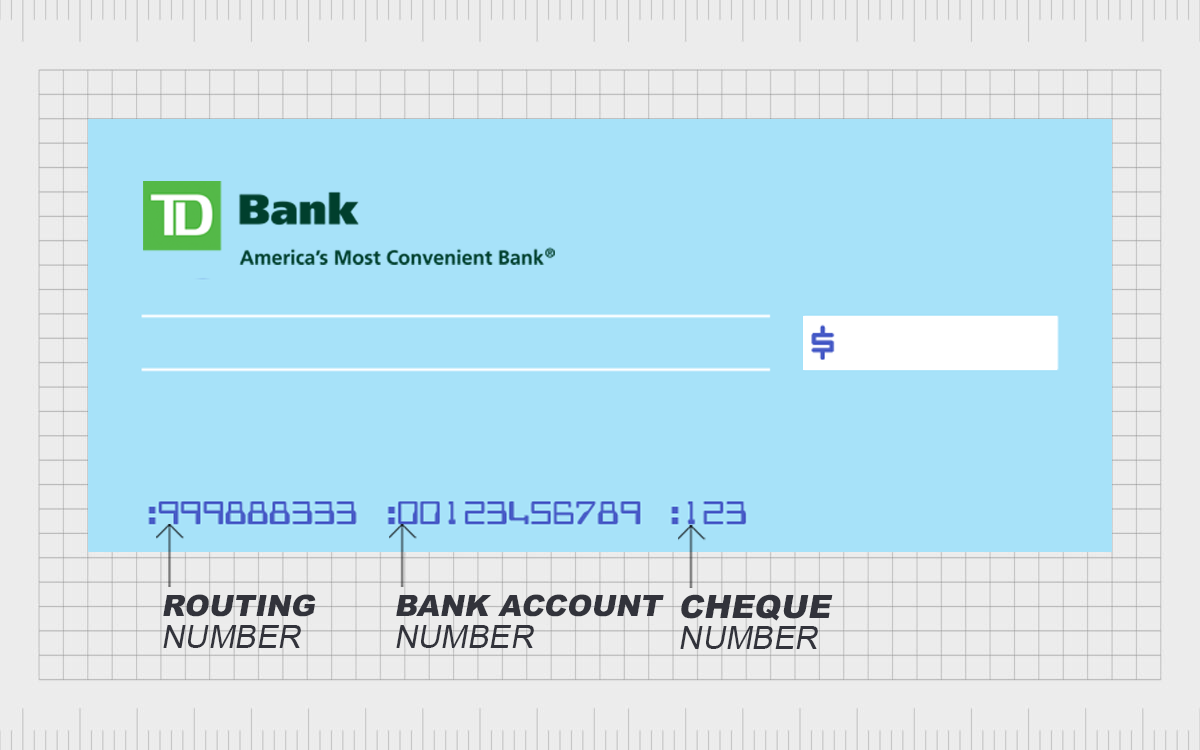

How to Find Updated TD Bank Routing Number (2024)