TD Bank Direct Deposit Address: Hassle-Free Electronic Transfers

Want to set up direct deposit with TD Bank? You'll need the bank's address to do so. Here's what you need to know.

TD Bank's address for direct deposit is:

TD Bank, N.A.

P.O. Box 94231

Palatine, IL 60094-4231

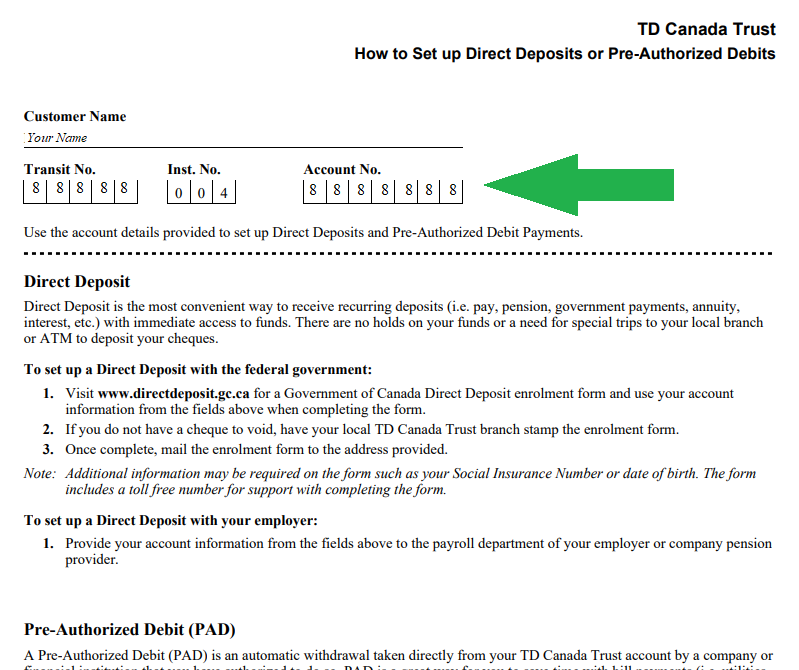

When setting up direct deposit, you'll also need to provide your account number and the routing number for your TD Bank account. The routing number is 026009593.

Direct deposit is a convenient and secure way to receive your paycheck or other payments. With direct deposit, your money is deposited directly into your TD Bank account on the day your payment is due. This eliminates the need to wait for a check to arrive in the mail or to visit a bank branch to deposit it.

To set up direct deposit, you'll need to contact your employer or other payer and provide them with the following information:

- Cole Y Dylan Sprouse

- Is James May Married

- Wizkid Net Worth 2024

- Emily Compagno Relationships

- Michael Ealy Siblings

- Your TD Bank account number

- The routing number for your TD Bank account (026009593)

- Your name and address

Once you've provided your employer or other payer with this information, they will be able to set up direct deposit for you. Your payments will then be deposited directly into your TD Bank account on the day they are due.

TD Bank Address for Direct Deposit

When setting up direct deposit with TD Bank, it's important to have the correct bank address. Here are seven key aspects to consider:

- Bank Name: TD Bank, N.A.

- Address: P.O. Box 94231, Palatine, IL 60094-4231

- Routing Number: 026009593

- Account Number: Your TD Bank account number

- Type of Deposit: Payroll, government benefits, etc.

- Frequency: Monthly, semi-monthly, weekly, etc.

- Effective Date: The date on which direct deposit will begin

By providing your employer or other payer with the correct TD Bank address and the other necessary information, you can ensure that your direct deposit will be processed smoothly and securely. Direct deposit is a convenient and efficient way to receive your payments, and it can help you avoid the hassle of dealing with checks.

1. Bank Name

The bank name, TD Bank, N.A., plays a crucial role in the context of "td bank address for direct deposit" as it identifies the specific financial institution where the direct deposit should be directed. Providing the correct bank name ensures that your direct deposit will be processed smoothly and securely and credited to the intended account.

- Accuracy: Using the correct bank name is essential to ensure that your direct deposit is processed correctly. If you provide an incorrect bank name, your deposit may be delayed or even rejected.

- Security: Providing the correct bank name helps protect your funds from fraud. By ensuring that your direct deposit is directed to your legitimate bank account, you reduce the risk of your money being intercepted by unauthorized individuals.

- Convenience: Having the correct bank name readily available eliminates the need to search for it when setting up direct deposit. This simplifies the process and saves you time and effort.

- Consistency: Using the correct bank name ensures consistency in your financial transactions. By providing the same bank name for all your direct deposit transactions, you can easily track and manage your finances.

In conclusion, the bank name, TD Bank, N.A., is an integral part of the "td bank address for direct deposit" process. It ensures accuracy, security, convenience, and consistency in the direct deposit of your funds.

2. Address

The address P.O. Box 94231, Palatine, IL 60094-4231, is the central component of "td bank address for direct deposit." It serves as the physical location where TD Bank receives and processes direct deposit transactions.

When you provide this address to your employer or other payer, you ensure that your direct deposit will be directed to the correct financial institution. The address acts as a unique identifier for TD Bank, enabling the direct deposit to be processed smoothly and securely.

Without the correct address, your direct deposit may be delayed, misdirected, or even rejected. Providing an incorrect address can lead to financial inconvenience and potential security risks.

Therefore, it is crucial to ensure that you provide the correct TD Bank address, P.O. Box 94231, Palatine, IL 60094-4231, when setting up direct deposit. This will help ensure that your funds are deposited accurately and efficiently into your TD Bank account.

3. Routing Number

The routing number 026009593 is an essential component of the "td bank address for direct deposit," forming a crucial connection in the process of electronically transferring funds into your TD Bank account.

Every financial institution in the United States is assigned a unique routing number, which serves as a code that identifies the specific bank and facilitates the secure and efficient routing of direct deposits. When you provide your employer or other payer with the TD Bank routing number, 026009593, you ensure that your direct deposit will be directed to the correct bank.

Without the correct routing number, your direct deposit may be delayed, misdirected, or even rejected, causing inconvenience and potential financial complications. Therefore, it is vital to ensure that you provide the accurate routing number, 026009593, when setting up direct deposit with TD Bank.

In summary, the routing number 026009593 plays a critical role in the "td bank address for direct deposit." It ensures that your direct deposit is processed smoothly and securely, directing your funds to the correct bank and account. Providing the correct routing number is essential for the successful and timely deposit of your funds.

4. Account Number

The account number associated with your TD Bank account plays a vital role in the "td bank address for direct deposit" process. It serves as a unique identifier for your specific account within TD Bank, ensuring that your direct deposit is credited to the correct destination.

When you provide your TD Bank account number along with the bank address, routing number, and other necessary information, you create a secure and direct pathway for your funds to be deposited electronically into your account. Without the correct account number, your direct deposit may be delayed, misdirected, or even rejected, potentially leading to financial inconvenience and complications.

Therefore, it is crucial to ensure that you provide the accurate TD Bank account number when setting up direct deposit. This can typically be found on your bank statement, online banking portal, or mobile banking app. By providing the correct account number, you can ensure the smooth and timely deposit of your funds into your intended TD Bank account.

5. Type of Deposit

The type of deposit, whether it's payroll, government benefits, or any other type of direct deposit, plays an important role in the context of "td bank address for direct deposit." Here are a few key facets to consider:

- Payroll Deposits: Payroll deposits are payments made by employers to their employees' bank accounts on a regular basis, usually twice a month or weekly. When setting up direct deposit for payroll, it's important to provide your employer with the correct TD Bank address, routing number, and account number to ensure that your paycheck is deposited accurately and on time.

- Government Benefits: Government benefits, such as Social Security, disability benefits, and veterans' benefits, can also be deposited directly into your TD Bank account. To set up direct deposit for government benefits, you'll need to provide the Social Security Administration or other relevant government agency with the necessary information, including your TD Bank address and account number.

- Other Types of Deposits: In addition to payroll and government benefits, there are various other types of payments that can be deposited directly into your TD Bank account. This may include tax refunds, insurance settlements, or payments from freelance work or online marketplaces.

Regardless of the type of deposit, it's important to ensure that you provide the correct TD Bank address, routing number, and account number to the sender. This will help ensure that your direct deposit is processed smoothly and securely and that your funds are deposited into the correct account.

6. Frequency

The frequency of your direct deposit, whether it's monthly, semi-monthly, weekly, or any other schedule, is an important consideration when setting up direct deposit with TD Bank. Here's how the frequency of your direct deposit interacts with the "td bank address for direct deposit":

When you provide your TD Bank address and other relevant information to your employer or other payer, you're essentially instructing them to send your direct deposit to your TD Bank account on a specific schedule. The frequency of your direct deposit determines how often this instruction is executed.

For example, if you set up monthly direct deposit, your employer will send your paycheck to TD Bank once a month, on the same day each month. If you set up semi-monthly direct deposit, your employer will send your paycheck twice a month, on the 15th and the last day of each month. Weekly direct deposit means that your employer will send your paycheck every Friday, and so on.

It's important to choose a direct deposit frequency that aligns with your financial needs and preferences. If you have regular expenses that occur on a specific schedule, such as rent or car payments, you may want to set up direct deposit to occur on the same day each month to ensure that these expenses are always covered on time.

Ultimately, the frequency of your direct deposit is a matter of personal preference. TD Bank offers a variety of direct deposit options to accommodate different needs, so you can choose the frequency that best suits your financial situation.

7. Effective Date

The effective date, which marks the commencement of direct deposit into your TD Bank account, is closely intertwined with the "td bank address for direct deposit." This date determines when your funds will be available in your account, allowing you to plan your finances accordingly.

- Advance Planning: The effective date enables you to anticipate the availability of your funds, empowering you to make informed financial decisions. By knowing the exact date your direct deposit will be processed, you can avoid overdrafts, late payments, or any financial disruptions.

- Timely Access to Funds: The effective date ensures that you have timely access to your funds. Whether it's for paying bills, making purchases, or simply managing your daily expenses, having your paycheck or other payments deposited on the designated date provides you with the flexibility and control over your finances.

- Consistency and Reliability: A consistent and reliable effective date instills confidence in your financial planning. When you know that your direct deposit will arrive on the same day each month or pay period, you can establish a predictable financial routine, reducing stress and uncertainty.

- Alignment with Pay Schedule: The effective date should ideally align with your pay schedule to ensure a seamless flow of funds. For instance, if you're paid on the last day of each month, setting the effective date to the following day would provide immediate access to your paycheck.

In conclusion, the effective date for direct deposit plays a crucial role in managing your finances effectively. By understanding the connection between the "td bank address for direct deposit" and the effective date, you can optimize your financial planning and ensure that your funds are available when you need them most.

FAQs on "td bank address for direct deposit"

This section addresses frequently asked questions and misconceptions surrounding "td bank address for direct deposit" to provide clarity and comprehensive understanding.

Question 1: What information is required to set up direct deposit with TD Bank?

To set up direct deposit, you'll need to provide your employer or other payer with the following information:

- Your TD Bank account number

- The routing number for your TD Bank account (026009593)

- Your name and address

Question 2: What is the address for direct deposit to TD Bank?

The address for direct deposit to TD Bank is:

TD Bank, N.A.

P.O. Box 94231

Palatine, IL 60094-4231

Question 3: How long does it take for direct deposit to appear in my TD Bank account?

Direct deposit typically takes 1-2 business days to appear in your TD Bank account. However, the timing may vary depending on the sender's processing time and your bank's policies.

Question 4: Can I set up direct deposit for different types of payments?

Yes, you can set up direct deposit for various types of payments, including payroll, government benefits, tax refunds, and payments from online marketplaces.

Question 5: What should I do if I have not received my direct deposit on the expected date?

If you have not received your direct deposit on the expected date, you should contact your employer or other payer to verify the payment status. You can also reach out to TD Bank customer service for assistance.

Summary:Understanding the "td bank address for direct deposit" is crucial for setting up direct deposit and ensuring timely access to your funds. By providing accurate information and following the appropriate steps, you can simplify the direct deposit process and manage your finances effectively.

Transition to the next article section:For further information on TD Bank's direct deposit services and other related topics, please explore the additional resources provided in the following sections.

Conclusion

The "td bank address for direct deposit" plays a pivotal role in ensuring that your funds are securely and efficiently deposited into your TD Bank account. Understanding the components and significance of this address empowers you to set up direct deposit effortlessly and manage your finances with confidence.

By providing the correct bank address, routing number, account number, and other necessary information, you establish a direct pathway for your deposits to reach their intended destination. The effective date ensures timely access to your funds, enabling you to plan your finances effectively and avoid financial disruptions.

Whether you receive payroll, government benefits, or other types of payments, direct deposit offers convenience, security, and peace of mind. By leveraging the "td bank address for direct deposit," you can harness the power of electronic fund transfer and simplify your financial management.

As technology continues to reshape the financial landscape, direct deposit remains a cornerstone of modern banking. By embracing this service and understanding the underlying mechanics, you can stay ahead in managing your finances and achieve your financial goals.

- Chris Mcnally Relationships

- Bill Burr Spouse

- P Diddy And Will Smith Relationship

- Wizkid Net Worth 2024

- Xxmx

EFT Information (TD Bank Example) SCRAPIT

Canada TD Bank proof of address statement template in Word and PDF

free direct deposit authorization form pdf word eforms direct deposit