Exploring The Public Status Of Facebook: A Comprehensive Overview

Is Facebook a Public Company?

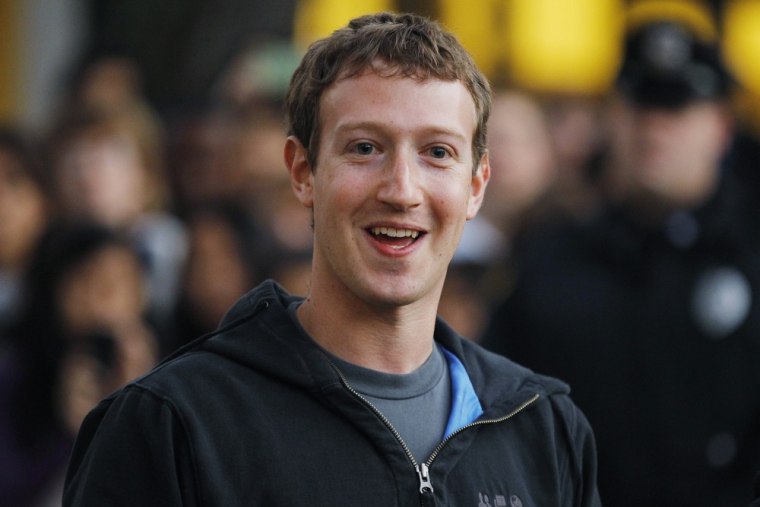

Facebook is an American multinational technology conglomerate based in Menlo Park, California. The company was founded by Mark Zuckerberg, Eduardo Saverin, Dustin Moskovitz, and Chris Hughes in February 2004. Facebook is a public company, meaning that its shares are traded on the stock market.

Facebook went public in May 2012, raising $16 billion in its initial public offering (IPO). The company's stock has performed well since then, and Facebook is now one of the most valuable companies in the world.

- Jason Momoa

- How Tall Is Christian Combs

- Poonawalla Family

- Vinnie Politan Wife And Kids

- Danny Dorosh And Kavan Smith Look Alike

There are several benefits to being a public company. One benefit is that it gives companies access to capital. When a company goes public, it can sell shares of its stock to raise money. This money can be used to fund new projects, expand the company's operations, or pay off debt.

Another benefit of being a public company is that it can increase the company's visibility and credibility. When a company goes public, it is subject to more scrutiny from investors and the media. This can help to increase the company's reputation and make it more attractive to potential customers and partners.

Of course, there are also some drawbacks to being a public company. One drawback is that it can be more difficult to make quick decisions. When a company is public, it must consider the interests of its shareholders before making any major decisions.

Another drawback of being a public company is that it can be more difficult to keep confidential information secret.

Is Facebook a Public Company?

Facebook is a publicly traded company, meaning that its shares are available for purchase on the stock market. This has a number of implications for the company, its shareholders, and the general public.

- Ownership: When a company goes public, it sells shares of its stock to the public. This means that the company is no longer owned by a small group of individuals, but by a large number of shareholders.

- Transparency: Public companies are required to disclose a great deal of information about their finances and operations to the public. This information is available to anyone who wants to invest in the company or learn more about it.

- Regulation: Public companies are subject to a number of regulations that are designed to protect investors. These regulations include requirements for financial reporting, corporate governance, and insider trading.

- Capital: Going public can give a company access to a large amount of capital. This capital can be used to fund new projects, expand the company's operations, or pay off debt.

- Liquidity: The shares of a public company can be bought and sold on the stock market. This means that investors can easily buy or sell their shares, which makes the investment more liquid.

- Risk: The stock market is volatile, and the value of a company's shares can fluctuate significantly. This means that investors in public companies can lose money if the company's stock price falls.

The decision to go public is a major one for any company. There are a number of factors to consider, including the company's financial , its growth prospects, and the regulatory environment. However, for companies that are able to successfully navigate the public markets, the benefits can be significant.

1. Ownership

When a company goes public, it sells shares of its stock to the public. This means that the company is no longer owned by a small group of individuals, but by a large number of shareholders. This can have a number of implications for the company, its shareholders, and the general public.

One of the most significant implications is that the company's ownership structure changes. When a company is privately held, it is owned by a small group of individuals, such as the founders, family members, and venture capitalists. However, when a company goes public, it sells shares of its stock to the public. This means that the company's ownership is now spread out among a large number of shareholders.

This change in ownership structure can have a number of consequences. For example, it can make it more difficult for the company to make quick decisions, as it must now consider the interests of its shareholders. Additionally, it can make the company more susceptible to takeover attempts, as a large shareholder could acquire enough shares to gain control of the company.

However, there are also a number of benefits to going public. One of the most significant benefits is that it can give the company access to a large amount of capital. This capital can be used to fund new projects, expand the company's operations, or pay off debt.

Another benefit of going public is that it can increase the company's visibility and credibility. When a company goes public, it is subject to a number of regulations that are designed to protect investors. This can help to increase the company's reputation and make it more attractive to potential customers and partners.

Overall, the decision to go public is a complex one that should be carefully considered by any company. There are a number of factors to consider, including the company's financial situation, its growth prospects, and the regulatory environment. However, for companies that are able to successfully navigate the public markets, the benefits can be significant.

2. Transparency

Transparency is a key aspect of being a public company. Public companies are required to disclose a great deal of information about their finances and operations to the public. This information is available to anyone who wants to invest in the company or learn more about it. This transparency is important for a number of reasons.

First, transparency helps to protect investors. When investors have access to information about a company's finances and operations, they can make more informed investment decisions. This can help to reduce the risk of fraud and abuse.

Second, transparency helps to promote accountability. When companies are required to disclose information about their finances and operations, they are more accountable to the public. This can help to deter companies from engaging in unethical or illegal behavior.

Third, transparency helps to build trust. When companies are transparent about their finances and operations, they build trust with the public. This trust is essential for attracting customers and partners.

Facebook is a public company, which means that it is subject to the same transparency requirements as other public companies. Facebook is required to disclose a great deal of information about its finances and operations to the public. This information is available to anyone who wants to invest in Facebook or learn more about the company.

The transparency requirements that apply to public companies are important for protecting investors, promoting accountability, and building trust. Facebook's status as a public company means that it is subject to these requirements, which helps to ensure that the company is transparent and accountable to the public.

3. Regulation

Facebook, being a public company, is subject to these regulations, which play a critical role in ensuring transparency, accountability, and investor protection.

- Financial Reporting

Public companies are required to disclose their financial information regularly, providing investors with a clear view of the company's financial health. This includes audited financial statements, quarterly and annual reports, and other relevant disclosures. Facebook, as a publicly traded company, must adhere to these reporting standards, ensuring that investors have access to accurate and up-to-date financial data. - Corporate Governance

Public companies are also subject to corporate governance regulations, which define the roles and responsibilities of the board of directors, management, and shareholders. These regulations aim to ensure that companies are managed in a responsible and ethical manner, protecting the interests of all stakeholders. Facebook's corporate governance structure, including its board composition, executive compensation, and shareholder rights, is shaped by these regulations. - Insider Trading

Insider trading regulations prohibit individuals with access to non-public information from using that information to trade in the company's stock. These regulations help maintain fair and orderly markets, preventing insiders from taking advantage of their privileged knowledge. Facebook, like other public companies, has implemented policies and procedures to prevent insider trading and ensure compliance with these regulations.

Overall, the regulations governing public companies, including financial reporting, corporate governance, and insider trading, play a vital role in protecting investors and ensuring the integrity of the markets. Facebook's status as a public company subjects it to these regulations, contributing to transparency, accountability, and investor confidence.

4. Capital

When a company goes public, it sells shares of its stock to the public. This gives the company access to a large amount of capital that can be used to fund new projects, expand the company's operations, or pay off debt. Facebook is a public company, which means that it has access to this type of capital.

- New projects: Facebook has used the capital it has raised from going public to fund a number of new projects, including the development of new products and services, the expansion of its data centers, and the acquisition of other companies.

- Expansion: Facebook has also used the capital it has raised from going public to expand its operations. The company has opened new offices around the world and has increased its headcount.

- Debt repayment: Facebook has also used the capital it has raised from going public to pay off debt. This has helped to improve the company's financial position and reduce its interest expenses.

Overall, going public has given Facebook access to a large amount of capital that has helped the company to grow and expand its business.

5. Liquidity

The liquidity of a public company's shares is an important factor for investors. Liquidity refers to the ease with which an asset can be converted into cash. The more liquid an asset is, the easier it is to sell and the lower the risk of losing money on the investment.

- Trading volume: The trading volume of a stock is a measure of how many shares are being bought and sold each day. A stock with a high trading volume is more liquid than a stock with a low trading volume.

- Bid-ask spread: The bid-ask spread is the difference between the highest price that a buyer is willing to pay for a stock and the lowest price that a seller is willing to accept. A stock with a narrow bid-ask spread is more liquid than a stock with a wide bid-ask spread.

- Market depth: The market depth of a stock is a measure of how many shares are available to be bought or sold at each price level. A stock with a deep market depth is more liquid than a stock with a shallow market depth.

- Volatility: The volatility of a stock is a measure of how much the price of the stock fluctuates. A stock with a high volatility is more risky than a stock with a low volatility.

Facebook is a public company, which means that its shares are traded on the stock market. This makes Facebook's shares more liquid than the shares of a private company. This liquidity is a benefit to investors because it allows them to easily buy or sell their shares.

6. Risk

Investing in public companies carries inherent risks due to the volatility of the stock market. Understanding these risks is crucial for those considering investing in Facebook or any other publicly traded company.

- Market Fluctuations: The stock market is subject to fluctuations influenced by various economic, political, and social factors. These fluctuations can lead to significant changes in a company's stock price, potentially resulting in losses for investors.

- Company Performance: The financial performance and overall health of a company can impact its stock price. Factors such as revenue growth, profitability, and competition can affect the value of the company's shares.

- Economic Conditions: Economic downturns, recessions, and other macroeconomic events can negatively impact the stock market, leading to declines in stock prices across various sectors, including technology companies like Facebook.

- Investor Sentiment: Market sentiment and investor confidence can influence stock prices. Negative news or events surrounding a company or the industry can lead to sell-offs and a decline in stock value.

While the potential for gains exists, investors should be aware of the risks associated with investing in public companies like Facebook. Careful consideration of factors such as market volatility, company performance, economic conditions, and investor sentiment is essential for making informed investment decisions.

FAQs

This section addresses frequently asked questions and provides informative answers regarding Facebook's status as a public company.

Question 1: Is Facebook a public company?

Answer: Yes, Facebook is a public company. It went public in May 2012, raising $16 billion in its initial public offering (IPO).

Question 2: What are the benefits of being a public company?

Answer: There are several benefits to being a public company. One benefit is that it gives companies access to capital. When a company goes public, it can sell shares of its stock to raise money. This money can be used to fund new projects, expand the company's operations, or pay off debt. Another benefit of being a public company is that it can increase the company's visibility and credibility.

Question 3: What are the risks of being a public company?

Answer: There are also some drawbacks to being a public company. One drawback is that it can be more difficult to make quick decisions. When a company is public, it must consider the interests of its shareholders before making any major decisions.

Another drawback of being a public company is that it can be more difficult to keep confidential information secret.

Question 4: How has going public impacted Facebook?

Answer: Going public has had a significant impact on Facebook. It has given the company access to a large amount of capital, which has helped Facebook to grow and expand its business. Going public has also increased Facebook's visibility and credibility, making it more attractive to potential customers and partners.

Question 5: What should investors consider before investing in Facebook?

Answer: Investors should carefully consider a number of factors before investing in Facebook. These factors include the company's financial performance, its growth prospects, and the overall market conditions. Investors should also be aware of the risks associated with investing in public companies, such as the volatility of the stock market.

By understanding the answers to these FAQs, individuals can gain a clearer understanding of Facebook's status as a public company and make informed decisions regarding potential investments.

Transition to the next article section:

Conclusion

In examining the question of whether Facebook is a public company, we have explored the various implications, benefits, and risks associated with its public status. As a publicly traded company, Facebook's ownership structure, transparency, regulation, access to capital, liquidity, and exposure to market risks have all been shaped by its decision to go public.

Understanding the nuances of being a public company is crucial for stakeholders, including investors, analysts, and the general public. It allows for informed decision-making, risk assessment, and a deeper comprehension of the company's operations and financial health. Facebook's journey as a public company serves as a valuable case study, highlighting the opportunities and challenges that come with operating in the public markets.

As Facebook continues to evolve and navigate the ever-changing landscape of technology and social media, its status as a public company will remain a significant factor influencing its growth, strategy, and relationship with its stakeholders. By embracing transparency, accountability, and the scrutiny that comes with being public, Facebook has positioned itself for continued success and impact in the years to come.

- Amber Heard And Jason Momoa Together

- Joe Locke Partner

- Vanessa Bryant Weight Loss

- Tony Hicks

- Khabib Wife

ชวนส่อง สวัสดิการสุดเจ๋ง! ของบริษัทยักษ์ใหญ่ ที่น่าทำตาม

Longterm investments in Facebook could be a bad bet, experts warn

Hướng dẫn lọc bạn bè không tương tác để cải thiện tương tác trên