Unveiling Barbara Sinatra's Last Will And Testament: An In-Depth Look

What is Barbara Sinatra's Last Will and Testament?

Barbara Sinatra's last will and testament is the legal document that outlines her wishes for the distribution of her assets after her death. It was drafted in 2017 and filed for probate in Clark County, Nevada, in 2020.

The document reveals that Barbara Sinatra left the bulk of her estate, estimated to be worth over $200 million, to her four children: Nancy Sinatra, Frank Sinatra Jr., Tina Sinatra, and Michael Sinatra. She also left significant bequests to several charities, including the Barbara Sinatra Children's Center and the Frank Sinatra School of the Arts.

| Personal Details | Information || --- | --- || Name | Barbara Marx Sinatra || Birth Date | March 10, 1927 || Birth Place | Bosworth, Missouri || Death Date | July 25, 2017 || Spouse | Frank Sinatra (1976-1998) || Children | Nancy Sinatra, Frank Sinatra Jr., Tina Sinatra, Michael Sinatra |

Barbara Sinatra's last will and testament is a matter of public record and provides insights into her personal life and financial affairs. It is a reminder of the importance of estate planning and the impact that a well-crafted will can have on the distribution of assets after death.

Barbara Sinatra's Last Will and Testament

Barbara Sinatra's last will and testament is a legal document that outlines her wishes for the distribution of her assets after her death. It was drafted in 2017 and filed for probate in Clark County, Nevada, in 2020. The document reveals several key aspects of her estate plan:

- Assets: Barbara Sinatra's estate was valued at over $200 million at the time of her death.

- Beneficiaries: The primary beneficiaries of her will were her four children: Nancy Sinatra, Frank Sinatra Jr., Tina Sinatra, and Michael Sinatra.

- Charities: Barbara Sinatra also left significant bequests to several charities, including the Barbara Sinatra Children's Center and the Frank Sinatra School of the Arts.

- Executor: Her son, Frank Sinatra Jr., was appointed as the executor of her estate.

- Contests: There were no known contests or disputes over the will.

- Probate: The will was admitted to probate in Clark County, Nevada, in 2020.

- Public Record: Barbara Sinatra's last will and testament is a matter of public record.

These key aspects provide insights into Barbara Sinatra's personal life and financial affairs. They also highlight the importance of estate planning and the impact that a well-crafted will can have on the distribution of assets after death.

1. Assets

Barbara Sinatra's last will and testament provides insights into the distribution of her assets, which were valued at over $200 million at the time of her death. This substantial wealth is a reflection of her successful career as a model, actress, and philanthropist.

- Estate Planning

Barbara Sinatra's last will and testament demonstrates the importance of estate planning. By creating a comprehensive will, she was able to ensure that her assets were distributed according to her wishes after her death. This is crucial for individuals with significant wealth who want to ensure their assets are managed and distributed effectively.

- Beneficiaries

The will reveals that Barbara Sinatra's primary beneficiaries were her four children: Nancy Sinatra, Frank Sinatra Jr., Tina Sinatra, and Michael Sinatra. This reflects her close relationship with her family and her desire to provide for their financial well-being.

- Charitable Giving

Barbara Sinatra's will also includes significant bequests to several charities, including the Barbara Sinatra Children's Center and the Frank Sinatra School of the Arts. This reflects her philanthropic spirit and her commitment to supporting organizations that make a positive impact on society.

- Tax Implications

The value of Barbara Sinatra's estate may have implications for estate taxes. In the United States, estates valued over a certain threshold are subject to federal estate tax. The executor of her estate will be responsible for ensuring that all estate taxes are paid before the assets are distributed to the beneficiaries.

Overall, the value of Barbara Sinatra's estate is a testament to her success and her commitment to her family and philanthropic causes. Her last will and testament provides valuable insights into her estate planning strategies and the distribution of her wealth.

2. Beneficiaries

The beneficiaries of Barbara Sinatra's last will and testament provide insights into her personal relationships and her priorities for the distribution of her assets. By naming her four children as the primary beneficiaries, she demonstrated her close familial bonds and her desire to ensure their financial well-being after her death.

- Family Ties

Barbara Sinatra's decision to leave the majority of her estate to her children reflects the importance she placed on family. Her will suggests that she had a strong relationship with her children and wanted to provide for their future.

- Estate Planning

Naming her children as beneficiaries is a common estate planning strategy. By doing so, Barbara Sinatra ensured that her assets would be distributed according to her wishes and that her children would be financially secure after her death.

- Financial Security

The substantial value of Barbara Sinatra's estate suggests that she wanted to ensure the financial security of her children. By leaving them the bulk of her assets, she provided them with the means to maintain their lifestyles and pursue their goals.

- Legacy

Barbara Sinatra's last will and testament is a reflection of her legacy as a loving mother and a successful businesswoman. By providing for her children, she ensured that her wealth and values would continue to benefit her family for generations to come.

In conclusion, the beneficiaries of Barbara Sinatra's last will and testament provide insights into her personal relationships, her estate planning strategies, and her desire to ensure the financial well-being of her family. Her will is a testament to the importance of family and the role that estate planning plays in preserving a legacy.

3. Charities

Barbara Sinatra's last will and testament reveals her commitment to philanthropy and her desire to support organizations that make a positive impact on society. Her bequests to the Barbara Sinatra Children's Center and the Frank Sinatra School of the Arts highlight her passion for helping children and promoting the arts.

- Support for Children

The Barbara Sinatra Children's Center is dedicated to providing support and services to abused, neglected, and at-risk children. Barbara Sinatra's bequest to this organization reflects her deep concern for the well-being of children and her desire to make a difference in their lives.

- Promotion of the Arts

The Frank Sinatra School of the Arts is a magnet school that provides specialized instruction in the performing arts. Barbara Sinatra's bequest to this school demonstrates her belief in the power of arts education and her commitment to nurturing young talent.

- Legacy of Giving

Barbara Sinatra's charitable bequests are a testament to her philanthropic spirit and her desire to leave a lasting legacy. Her support for organizations that focus on children and the arts ensures that her values and passions will continue to benefit the community long after her passing.

In conclusion, Barbara Sinatra's bequests to charities in her last will and testament reflect her deep commitment to making a positive impact on the world. Her support for children and the arts highlights her compassion, her belief in the power of education, and her desire to leave a lasting legacy.

4. Executor

The appointment of Frank Sinatra Jr. as the executor of Barbara Sinatra's last will and testament is a crucial aspect of her estate planning and reflects the trust and confidence she placed in her son to carry out her wishes after her death.

- Role of an Executor

An executor is a person or institution appointed by the testator (the person who makes the will) to oversee the administration of their estate after their death. The executor's responsibilities include gathering the deceased's assets, paying off debts and taxes, and distributing the remaining property to the beneficiaries according to the will's instructions.

- Significance in Barbara Sinatra's Will

The appointment of Frank Sinatra Jr. as executor suggests that Barbara Sinatra had a close relationship with her son and trusted him to handle her financial and legal affairs after her passing. It also demonstrates her confidence in his ability to manage her estate effectively and carry out her wishes as outlined in the will.

- Legal and Financial Implications

The executor of an estate has significant legal and financial responsibilities. They are required to act in the best interests of the estate and its beneficiaries, and they can be held personally liable for any mismanagement or breach of duty.

- Personal Considerations

In addition to the legal and financial aspects, the role of executor can also be emotionally challenging. The executor is often responsible for making difficult decisions, dealing with grieving family members, and ensuring that the deceased's wishes are respected.

In conclusion, the appointment of Frank Sinatra Jr. as the executor of Barbara Sinatra's last will and testament highlights the importance of careful estate planning and the trust and responsibility placed upon the executor. It also provides insights into the personal relationship between Barbara Sinatra and her son, and the legal and financial implications of managing an estate.

5. Contests

The absence of known contests or disputes over Barbara Sinatra's last will and testament provides insights into the clarity and validity of the document, as well as the harmonious relationships among her family members.

- Validity of the Will

Contests or disputes over a will can arise due to various factors, such as ambiguities in language, allegations of undue influence, or claims of forgery. The absence of such contests suggests that Barbara Sinatra's will was carefully drafted and executed, ensuring its legal validity.

- Clarity of Intentions

A well-drafted will clearly outlines the testator's wishes for the distribution of their assets, minimizing the potential for misinterpretations or disputes. The lack of contests over Barbara Sinatra's will indicates that her intentions were clearly expressed, leaving little room for ambiguity.

- Family Harmony

Contests over a will can often arise from conflicts or disagreements among family members. The absence of such disputes in Barbara Sinatra's case suggests harmonious relationships within her family, with her beneficiaries respecting her wishes and the distribution of her assets.

- Legal Implications

The lack of contests or disputes over Barbara Sinatra's will has significant legal implications. It simplifies the probate process, reduces the likelihood of legal challenges, and ensures a smoother distribution of her assets according to her wishes.

In conclusion, the absence of known contests or disputes over Barbara Sinatra's last will and testament reflects the clarity of her intentions, the validity of the document, and the harmony among her family members. This provides a comprehensive understanding of her estate planning and its implications.

6. Probate

Probate is a legal process that validates a will and ensures its proper execution. In the case of Barbara Sinatra's last will and testament, the probate process took place in Clark County, Nevada, in 2020. This step was crucial for several reasons:

- Legal Validation

Probate serves as a legal confirmation of the will's authenticity and validity. It involves the court's review of the will to assess its compliance with legal requirements and to ensure that it accurately reflects the testator's (Barbara Sinatra's) wishes. - Authorization of Executor

Probate grants legal authority to the executor named in the will, in this case, Frank Sinatra Jr. The executor is responsible for administering the estate, managing its assets, paying debts and taxes, and distributing the remaining property to the beneficiaries as per the will's instructions. - Protection of Beneficiaries

Probate provides legal protection to the beneficiaries by safeguarding their inheritance rights. It ensures that the will is executed according to the testator's intentions and that their wishes are respected.

The probate process also includes the following steps:

- Filing the Will: The executor files the original will with the probate court, along with a petition for probate.

- Notice to Beneficiaries: The executor notifies all beneficiaries and interested parties about the probate proceedings.

- Review by the Court: The probate court reviews the will, examines its validity, and ensures that it complies with legal requirements.

- Granting of Probate: If the will is found to be valid, the probate court issues an order admitting it to probate, officially recognizing its legal status.

Barbara Sinatra's will was admitted to probate in Clark County, Nevada, in 2020, signifying the legal validation of her final wishes and the authorization of her chosen executor to administer her estate. This process plays a critical role in ensuring the proper execution of a will, protecting the rights of beneficiaries, and facilitating the distribution of assets according to the testator's intentions.

7. Public Record

Barbara Sinatra's last will and testament is a public record, meaning that it is accessible to the public upon request. This is because wills are considered legal documents that are filed with the probate court after the testator's death. Once admitted to probate, the will becomes a matter of public record, and anyone can obtain a copy by contacting the court.

- Transparency and Accountability

Making wills public record promotes transparency and accountability in estate administration. It allows interested parties, such as beneficiaries, creditors, and researchers, to scrutinize the document and ensure that the testator's wishes are being carried out as intended.

- Historical and Genealogical Research

Wills can be valuable sources of historical and genealogical information. They often contain details about the testator's family relationships, property holdings, and personal effects. Researchers can use this information to piece together family histories and gain insights into the lives of their ancestors.

- Legal Precedents and Case Studies

Public wills can also serve as legal precedents and case studies for legal professionals. Attorneys and judges can examine how courts have interpreted similar wills in the past, which can help them make informed decisions in their own cases.

- Protection Against Fraud and Abuse

Public access to wills can help protect against fraud and abuse. If a will is contested, the public record provides a transparent account of the testator's wishes, making it more difficult for dishonest parties to alter or manipulate the document.

In conclusion, the public record status of Barbara Sinatra's last will and testament serves multiple purposes. It promotes transparency, facilitates historical research, provides legal guidance, and safeguards against potential wrongdoing. Understanding the implications of public wills is essential for anyone interested in estate planning, genealogy, or legal matters.

FAQs on Barbara Sinatra's Last Will and Testament

This section addresses frequently asked questions and provides informative answers regarding Barbara Sinatra's last will and testament.

Question 1: Why is Barbara Sinatra's last will and testament a matter of public record?

Answer: Wills are legal documents filed with the probate court after the testator's death. Once admitted to probate, they become public records to promote transparency, facilitate historical research, provide legal guidance, and protect against fraud.

Question 2: Who was appointed as the executor of Barbara Sinatra's estate?

Answer: Frank Sinatra Jr. was appointed as the executor of Barbara Sinatra's estate. The executor is responsible for administering the estate, managing its assets, paying debts and taxes, and distributing the remaining property to the beneficiaries as per the will's instructions.

Question 3: Were there any known contests or disputes over Barbara Sinatra's will?

Answer: There were no known contests or disputes over Barbara Sinatra's last will and testament, suggesting the clarity and validity of the document, as well as the harmonious relationships among her family members.

Question 4: What is the significance of probate in relation to Barbara Sinatra's will?

Answer: Probate is a legal process that validates a will, grants legal authority to the executor, and protects the rights of beneficiaries. In Barbara Sinatra's case, the probate process took place in Clark County, Nevada, in 2020.

Question 5: What insights can be gained from Barbara Sinatra's charitable bequests in her will?

Answer: Barbara Sinatra's bequests to the Barbara Sinatra Children's Center and the Frank Sinatra School of the Arts highlight her commitment to supporting children and promoting the arts. These bequests reflect her values and her desire to leave a lasting legacy.

In summary, Barbara Sinatra's last will and testament provides valuable insights into her estate planning strategies, her personal relationships, and her philanthropic endeavors. Understanding the key aspects of her will helps us appreciate the legal and practical considerations involved in estate administration.

Transition to the next article section:...

Conclusion

Barbara Sinatra's last will and testament provides a comprehensive insight into her estate planning, personal relationships, and philanthropic endeavors. The document reveals her desire to ensure the well-being of her family, her commitment to supporting charitable causes, and the trust she placed in her son, Frank Sinatra Jr., as the executor of her estate.

The absence of contests or disputes over the will highlights the clarity and validity of the document, as well as the harmonious relationships among Barbara Sinatra's family members. The public record status of the will promotes transparency and accountability in estate administration, making it accessible for historical research and legal scrutiny.

Overall, Barbara Sinatra's last will and testament serves as a valuable case study for estate planning professionals, legal scholars, and anyone interested in the legacy of one of the most iconic figures in entertainment history.

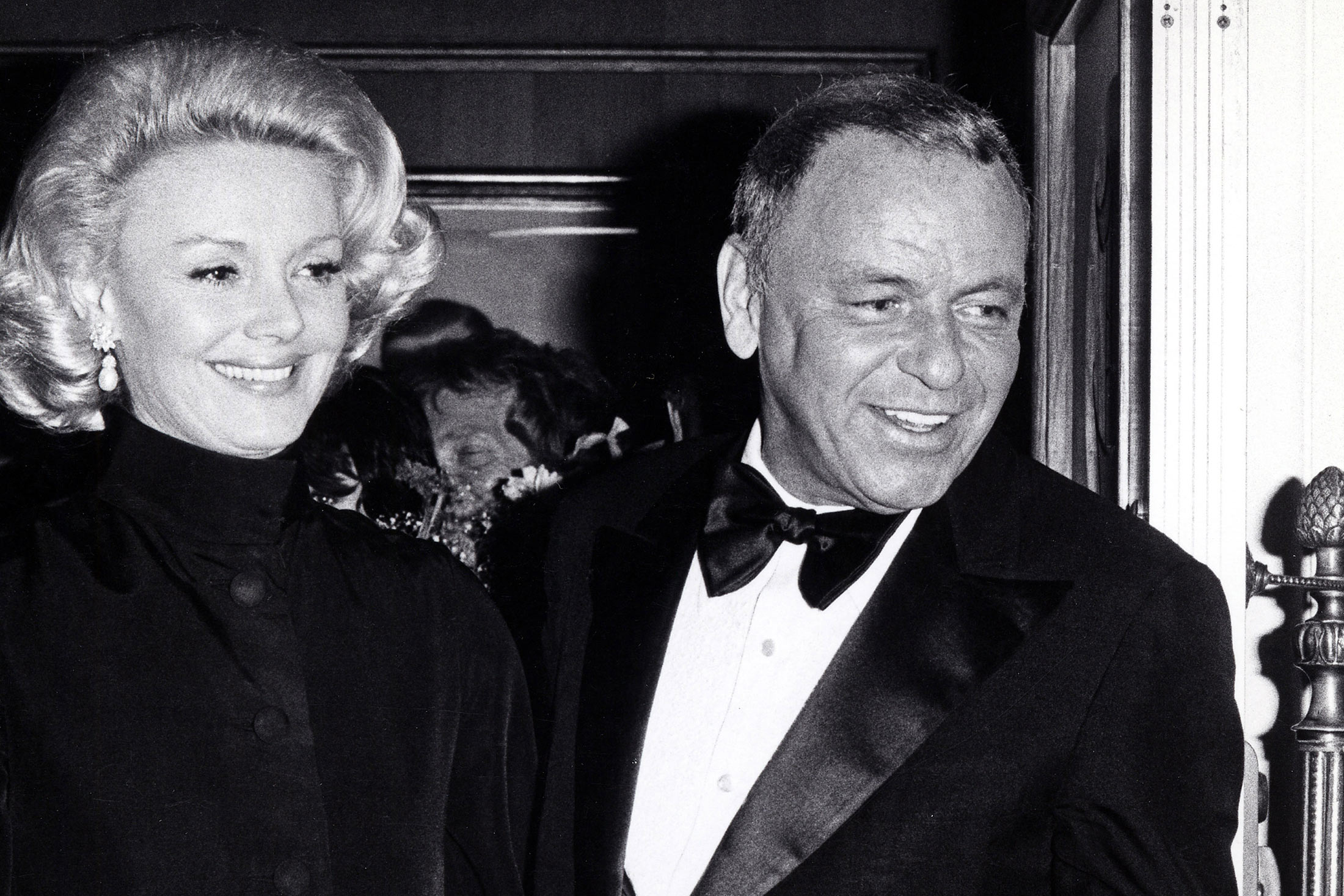

Philanthropist Barbara Sinatra, widow of Frank Sinatra, dead at 90

Barbara Sinatra, Frank's 4th Wife and Widow, Dies at 90 Bloomberg

Barbara Sinatra, widow of Frank, passes away aged 90 Moving To